Bankruptcy Lawyer Somerville, TN

Even if you’re not yet sure that filing for bankruptcy is the best way forward, if you’re thinking about it as an option, schedule a free case evaluation with a bankruptcy lawyer Somerville, TN from Darrell Castle & Associates, PLLC. There are no strings attached to this process, it’s more straightforward than you might think. A free consultation simply allows you to learn more about your options so that you can make an informed decision about how to handle your family’s financial situation.

You may have a lot of questions you want to ask an attorney, especially if you’re not familiar with bankruptcy law or you are filing for bankruptcy for the first time. If you do decide that filing for bankruptcy is the way to go, you’ll likely (unless you’re a small business owner) file under either Chapter 7 or Chapter 13 of the Bankruptcy Code. There are potential benefits and drawbacks to each approach.

We understand that bankruptcy comes with a lot of uncertainty and can cause added stress during a frustrating time. However, there have been many clients who go through bankruptcy and are able to achieve financial recovery, and often come out with better control and knowledge of their financial goals and habits.

Regardless of how you got to this stage, know that you have the tools to get yourself on the right track. Rest assured that our experienced bankruptcy lawyer team will walk you through what you need to know to make an informed choice.

What Are the Differences Between Chapter 7 and Chapter 13 Bankruptcy?

There are three major differences between Chapter 7 and Chapter 13 bankruptcy. The first is that Chapter 7 bankruptcy is only available to members of households whose income doesn’t exceed a specific limit. Essentially, the less money you make, the more likely it is that you’re eligible for Chapter 7 bankruptcy relief. This type of bankruptcy applies to many low-income individuals.

The second difference is that the Chapter 7 bankruptcy process doesn’t require filers to repay a portion of their eligible debts before the remaining balance can be discharged by the court. By contrast, Chapter 13 filers are required to make manageable monthly payments on the whole of their debt for 3-5 years before any remaining eligible debt will be discharged.

Finally, whereas Chapter 13 bankruptcy reorganizes debt so that paying it becomes manageable, Chapter 7 bankruptcy is referred to as “liquidation bankruptcy” because of a provision that allows a filer’s non-exempt property to be sold to pay their creditors. Thankfully, most property that an average family owns is classified as exempt, so chances are relatively slim that you’ll have property that would be sold in the event that you’re eligible to file for Chapter 7 bankruptcy. If you have additional questions, we can explain how this process works in detail during your free consultation.

How Should I Prepare for a Bankruptcy Consultation?

It can be helpful to gather some information before you meet with an experienced bankruptcy lawyer at our firm. The more prepared you are for your consultation, the more informed our assessment of your legal options will be. When evaluating your case, a bankruptcy court will consider your income, expenses, debts, and property/assets. As a result, you’ll want to give our firm a picture of each of these aspects of your finances that is as complete as it can reasonably be.

For example, you’ll want to pull a free copy of your credit report in order to give us a strong sense of what your debt load is, which creditors you owe, and what your credit history looks like. Additionally, we’ll benefit from looking at recent paystubs, etc. in order to get a good sense of your income. If you can pull together a basic list of your property and assets (and how much they are worth), that will also be helpful. Finally, if you have a household budget or other list of common expenses, that will assist us in accurately weighing your options as well.

In addition to gathering documentation, take some time to write down any questions you may have about filing for bankruptcy, our firm’s approach to representation, your legal options, etc. We will do our utmost to address each concern in turn, so that you’ll be as informed as you can be when it comes time to commit to one plan of action or another.

Should I Be Worried About My Credit Score?

Understandably, many individuals who file for bankruptcy are concerned about how this turn of events will affect their credit history and their overall credit score. It’s true that filing for bankruptcy will cause your credit score to dip temporarily. It’s also true that your bankruptcy filing will remain noted on your credit history for a number of years. However, filing for bankruptcy can actually help your credit more than hurt it over time.

Every time that a creditor reports a late payment, an overdue balance, a collections action, etc. to the major credit bureaus, that activity becomes part of your credit history. When you file for bankruptcy, that will result in a single negative “hit” on your credit. However, many filers are surprised to learn that this activity tends to harm their credit less than continuing to remain overstretched regarding their debt.

In fact, studies have shown that filers generally see an improvement in their credit score just one year post-bankruptcy as compared to their credit score on the day they filed. Contrast this reality with what would happen to your credit score if you remained in a debt spiral for a year, with your credit score sinking and sinking with no concrete way with which to improve it. As long as you engage in responsible debt-related habits post-bankruptcy, filing for this form of debt relief with the assistance of the experienced Tennessee legal team at Darrell Castle and Associates, PLLC can ultimately do your credit score more good than harm.

What Comes Next? Next Steps After Filing for Bankruptcy

Contrary to what many may assume, filing for bankruptcy can have its advantages. Bankruptcy may have negative implications, but for some it might be the best option. It can even come with positive effects depending on your financial situation. If you are suddenly faced with debt you’re not able to pay, filing for bankruptcy can actually ease your financial burden. It has the ability to end wage garnishment, as well as stopping foreclosure and repossession. It can end harassment from any creditors who routinely try to contact you.

Bankruptcy can put you on a path to financial freedom so you can take charge of your money again. It can open more opportunities for you than you expect. With an open mind and the added financial knowledge that you’ll have after filing for bankruptcy, you will be better prepared to handle your money in a smarter and more efficient way. With the help of their lawyer, many clients have boosted their credit score, resulting in manageable car or loan payments. You will be aware of helpful practices to manage or avoid debt, and it might even inspire you to come up with creative streams of income. Though it might be scary at first, bankruptcy lifts the burden off of your shoulders so that you can have the confidence to move forward and enjoy your financial freedom.

Tips to Avoid Foreclosure

Though banks do have the power to strip hardworking and responsible homeowners of their houses, there are tried and true ways that individuals can stop foreclosure from happening. There are a number of legal and financial resources homeowners can utilize to fight any threats that could pose risks of foreclosure. The earlier homeowners can do their research about which tools best fit their unique circumstances and could be most helpful for them, the more options they can take advantage of. It’s always better to take action sooner than later, considering that negotiating debt and determining financial agendas demand a lengthy amount of time and requires careful planning. For full guidance on the use of these tools and recommended strategies, it’s best to consult a bankruptcy lawyer in Somerville, Tennessee. During this stressful time, know that there are available options that can help you navigate this difficult situation.

Legal Assistance Is Available

You don’t need to have “all the answers” about bankruptcy before meeting with the experienced Tennessee legal team at Darrell Castle & Associates, PLLC. Knowing the ins and outs of bankruptcy law is our job. And it is our great privilege to assist those who are struggling with debt to manage that debt through bankruptcy. Too often, hardworking, responsible people fall on hard times through no fault of their own.

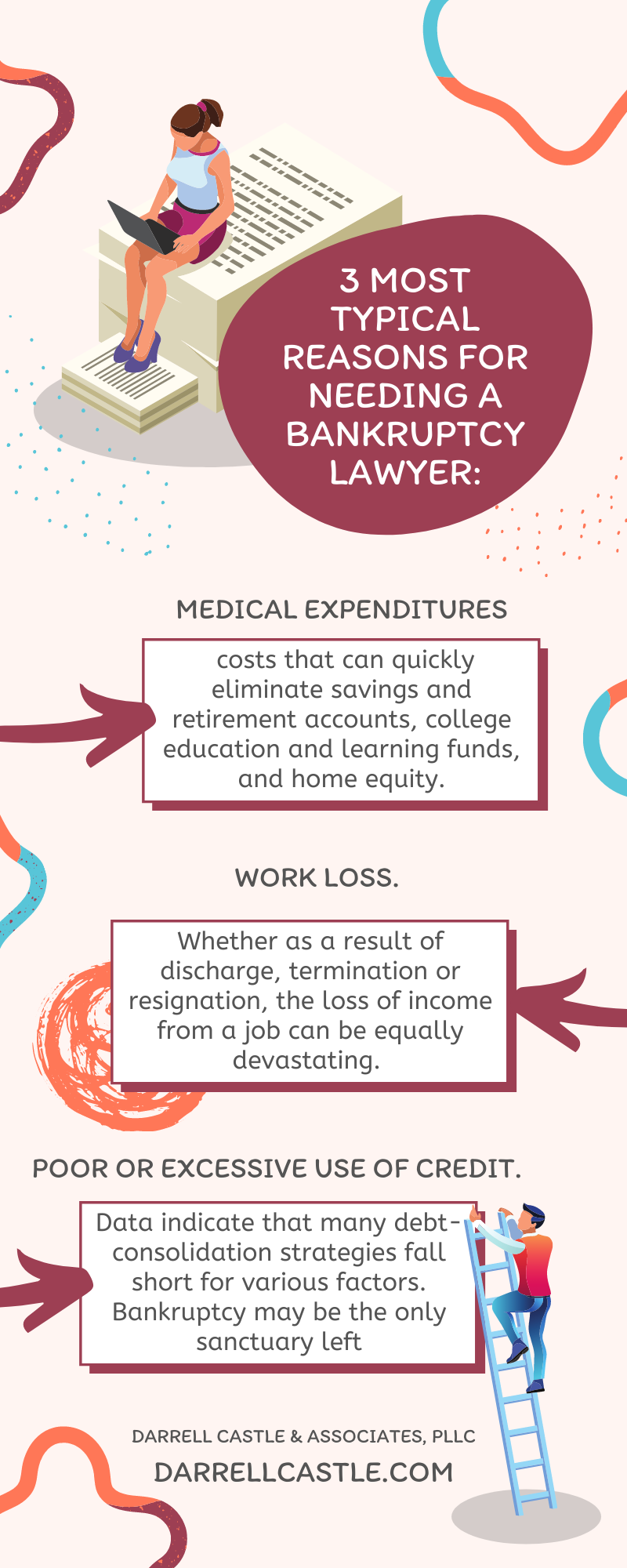

Thankfully, the bankruptcy system is available to help “right the ship” when either an unexpected storm or seemingly never-ending rain makes it unreasonably difficult for families to continue on their journeys unimpeded. If you’re interested in filing for bankruptcy, connect with a Somerville, TN bankruptcy lawyer at our firm today; we look forward to speaking with you. Three most typical reasons for needing a bankruptcy lawyer:

1) Medical Expenditures

A study released in the American Journal of Public Health in 2019 found that 66.5% of insolvencies in the US were due to clinical issues like being incapable of paying the high costs of medical expenses.

Uncommon or severe illness or injuries can conveniently cause hundreds or thousands of dollars in medical expenses– costs that can quickly eliminate savings and retirement accounts, college education and learning funds, and home equity.

Once these have actually been worn down, bankruptcy may be the only shelter left, no matter whether the client or his/her family was able to apply health insurance coverage to a section of the costs or not.

2) Work Loss.

Whether as a result of discharge, termination or resignation, the loss of income from a job can be equally devastating. Some are fortunate enough to obtain severance packages, yet several find pink slips on their desks or lockers with little or no prior notice.

Not having a reserve to draw from just intensifies this circumstance, and also making use of credit cards to pay bills can be disastrous. According to Bankrate’s 2019 Financial Security Index Survey, virtually three out of 10 Americans do not have emergency cost savings accessible to assist in the case of a job loss or various other monetary situations.

Medical financial obligation and also work loss due to health problems continue to be the cause of over half of American personal bankruptcies.It is one of the main reasons people contact a bankruptcy lawyer. 3 out of 10 Americans do not have a reserve.Insolvency is commonly considered as a last hope in an economic dilemma.

The loss of insurance coverage and also the price of COBRA insurance coverage can monetarily drain a persons already limited sources. Those who are not able to locate similar rewarding employment for an extended amount of time might not have the ability to recuperate from the lack of earnings in time to keep the lenders at bay.

3) Poor or Excessive Use of Credit.

Some people simply can’t control their costs. Credit card costs, installment debt, vehicle, and other financing payments can eventually spiral out of control until ultimately, the debtor is unable to make the minimum payment on each type of debt.

Having an emergency fund, medical insurance coverage, and also maintaining your debt-to-credit proportion are all means to secure on your own from a future affirmation of bankruptcy.

If the consumer can not access funds from friends or family or otherwise get debt-consolidation, then bankruptcy is normally the unpreventable option.

Data indicate that many debt-consolidation strategies fall short for various factors, as well as normally just postpone declaring insolvency for most participants. Although home-equity financing can be an excellent remedy for unprotected debt sometimes, once it is exhausted, careless customers can face foreclosure on their houses if they are not able to make this repayment.

When these have actually been tried, bankruptcy may be the only sanctuary left, no matter whether the individual or his or her family members was able to apply wellness coverage to a portion of the expense or not.

Signs You May Be Headed Towards Bankruptcy

Financial stability is a fundamental aspect of a secure and comfortable life. However, for many individuals and businesses, the road to bankruptcy can be a gradual descent filled with warning signs. Recognizing these signs early can help you take corrective actions and potentially avoid the dire consequences of bankruptcy. Here are some key indicators that you may be headed towards bankruptcy:

1. Mounting Debt:

One of the most obvious signs of impending bankruptcy is a rapidly growing pile of debt. If your credit card balances, loans, and outstanding bills are continuously increasing, it’s time to take a closer look at your financial situation. Ignoring your debts won’t make them disappear.

2. Missed Payments:

Consistently missing bill payments or making only minimum payments on your credit cards can indicate financial trouble. Late fees and interest charges can exacerbate your debt problems, making it harder to catch up.

3. Declining Income:

A decrease in your household income due to job loss, reduced hours, or a business downturn can put immense strain on your finances. If your income is no longer sufficient to cover your basic living expenses, bankruptcy may become a real possibility.

4. Using Credit to Cover Expenses:

Relying on credit cards or loans to pay for everyday expenses, such as groceries or utility bills, is a clear warning sign. It’s essential to live within your means and not accumulate debt to maintain your lifestyle.

5. No Emergency Savings:

Lack of an emergency fund can leave you vulnerable to unexpected expenses, such as medical bills or car repairs. If you don’t have savings to fall back on, you may find yourself turning to credit, pushing you further into debt.

6. Constant Collection Calls:

Continuous calls from debt collectors can be both stressful and indicative of financial distress. If you’re regularly hounded by creditors, it’s time to assess your financial situation and seek help.

7. Legal Actions:

Lawsuits, wage garnishments, or foreclosure proceedings are serious signs that your financial situation is in dire straits. Legal actions can have long-lasting consequences, making bankruptcy a potential solution.

8. Decreased Credit Score:

A plummeting credit score reflects your worsening financial health. Lenders use your credit score to assess your creditworthiness, and a low score can limit your access to credit or increase borrowing costs.

9. Borrowing from Retirement Accounts:

Withdrawing money from retirement accounts like 401(k)s or IRAs to cover expenses is a last resort that can have significant financial repercussions. Not only do you deplete your retirement savings, but you may also incur penalties and taxes.

10. Ignoring Financial Planning:

Avoiding budgeting, financial planning, and seeking professional advice can contribute to financial problems. Developing a realistic budget and seeking assistance from financial advisors can help you regain control.

11. Unmanageable Student Loans:

If your student loan debt becomes unmanageable and you’re unable to make payments, it can lead to severe financial consequences. Exploring options like income-driven repayment plans or loan consolidation is crucial.

12. Overextended Business:

For businesses, a sharp decline in revenue, increasing overhead costs, or a drop in market demand can lead to insurmountable challenges. Overextended businesses may need to consider bankruptcy as a means of restructuring or liquidation.

While these signs can be alarming, they also serve as early warnings that you can use to address your financial situation proactively. Seeking help from a credit counselor, financial advisor, or bankruptcy attorney can provide you with the guidance and resources needed to make informed decisions and potentially avoid bankruptcy. Remember that recognizing the signs and taking action sooner rather than later can make a significant difference in your financial future.

Bankruptcy Lawyer in Somerville, TN

You may have heard that bankruptcy is a good way to wipe out your debt, but what might be less clear is the best way to proceed. If you are considering bankruptcy, you probably have a lot of questions about how the process works. The more you know about bankruptcy, the better equipped you will be to handle it.

A good bankruptcy lawyer Somerville, TN from Darrell Castle & Associates can answer a lot of these questions and will explain everything in detail. Not only will they explain the complicated legal proceedings to you, but they can also give you advice on how to handle your finances as well.

Below are some frequently asked questions about bankruptcy to help get you started.

What is bankruptcy?

Bankruptcy is a legal process that provides relief from the financial burdens of debt. It allows individuals to eliminate debt, repay creditors and get a fresh start.

How does bankruptcy work?

The filing of a bankruptcy petition automatically stays most collection actions against the debtor or the debtor’s property. Also, most types of creditors cannot initiate or continue lawsuits, wage garnishments, or even telephone calls demanding payments.

What debts can be eliminated in bankruptcy?

With few exceptions, most debts can be eliminated in bankruptcy. However, some debts may not be eliminated in certain types of bankruptcy cases. Depending on what type of case you file, student loans, alimony payments, back taxes, and criminal fines may still need to be paid.

Should I file for bankruptcy?

The decision to file for bankruptcy will depend on your particular circumstances and objectives. An experienced bankruptcy lawyer Somerville, TN can help you understand the benefits and consequences of filing and advise you as to whether or not it is right for you. A free consultation will help you determine if filing for bankruptcy makes sense for your situation.

How do I file for bankruptcy?

There are several steps involved in filing for bankruptcy. These include: obtaining documents that show your income, assets and liabilities; attending credit counseling; completing required forms and schedules; and filing your petition with the court. A bankruptcy lawyer in Somerville, TN can help walk you through these steps and make sure everything is done correctly.

What are the different types of bankruptcy?

There are two main forms of bankruptcy available to individuals: Chapter 7 and Chapter 13. These two options have different applications and criteria, so it’s important to understand which is right for your situation before making a decision.

Am I eligible for Chapter 7 or 13?

To qualify for either type of bankruptcy, you must pass a means test that analyzes your income over 6 months and determines whether you have enough disposable income left each month after paying off secured debts, such as mortgages or car loans, to pay unsecured debt like credit cards or medical bills. If so, then you may not be eligible for Chapter 7 bankruptcy and instead will be required to file for Chapter 13 instead.

Bankruptcy can be a scary word for anyone, but take a deep breath! There is no shame in declaring bankruptcy as long as you have done everything you could do to avoid it. Taking steps before you are officially bankrupt, such as talking with a bankruptcy lawyer from Darrell Castle & Associates, will help you know what action to take when you find yourself in an unfortunate financial situation.

How do You Assess Your Financial Situation?

To figure out if you need to give your financial situation more thought, you need to ask yourself some questions. The simplest way to put bankruptcy is when you owe more than you can afford to pay. Here are some things to ask before you have your heart set on bankruptcy:

- Do you only make the minimum payments on your credit cards?

- Do you have bill collectors calling you non-stop?

- Does the thought of sorting out your finances make you feel scared or out of control?

- Are you unsure of how much you owe?

- Are you considering debt consolidation?

If you answered yes to two or more of those questions then you may need to consider bankruptcy to help solve the issue. However, it shouldn’t be approached casually as there is no easy fix to debt.

Can You Keep Your Property?

This is going to depend on what chapter you are filing under. Under Chapter 13 the answer is yes. With this plan, you repay all or a portion of your debts through a repayment plan over a period of three to five years. In exchange, you get to keep your property such as your car and home as long as you keep up with the payments.

If you filed a Chapter 7 bankruptcy then you can ask the court to discharge most of the debts you owe. In exchange, the bankruptcy trustee can take any property you women that is not exempt from the collection and sell it to distribute the proceeds to your creditors. What are exempt changes from state to state and that is why a lawyer is needed. They can help you know what you get to keep and what will have to be sold.

Will Bankruptcy Stop Harassing Phone Calls From Debt Collectors?

The short answer is yes it will. It requires most creditors and debt collectors to stop all communication efforts against you until the bankruptcy is over. However, if all you want is to stop the calls there are other ways to do it. Under the Fair Debt Collection Practice Act, you can request the contact be ceased. This only works on debt collectors though and not creditors.

Even if you aren’t sure if filing for bankruptcy is the best way forward, it will not hurt to contact a bankruptcy lawyer in Somerville, Tennessee from Darrel Castle & Associates, PLLC for a free consultation. There is no reason you should go into this alone and be full of questions about if it is the right choice for you.

Contact Your Bankruptcy Lawyer

Bankruptcy isn’t something you should fear if it’s an option that will be best for your situation. As a business owner, you have to protect both your personal and business assets, and working with a lawyer might be the best way to achieve that. If you find yourself searching for a TN bankruptcy lawyer in Sommerville, please contact Darrell Castle & Associates, PLLC.