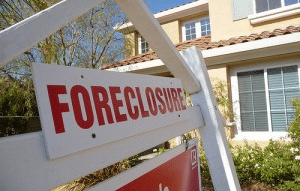

Stop Foreclosure Through Bankruptcy

If you’re facing foreclosure, you need a solution, and fast. Our Memphis bankruptcy lawyers have helped thousands of Memphis residents stop foreclosure, save their homes, and get out of debt – and we can help you, too.

Protecting your home from foreclosure can seem like a scary process. But it doesn’t have to be. We help make everything simple, and we use the force of law to stop foreclosure in its tracks.

How Chapter 13 Stops Foreclosure

There are two main types of bankruptcy that help individuals get out of debt: Chapter 7 and Chapter 13.

Generally, to stop a foreclosure, you’ll want to file Chapter 13 bankruptcy. With Chapter 13, we help compile all of your debts — including your past-due mortgage payments — into an affordable 3-5 year repayment plan. The plan takes your personal finances into account, so you can actually afford the payments.

With this simple setup, you can keep your home and get out of debt. And when the bankruptcy ends, you’ll be current on your mortgage. It’s a powerful and life-changing tool.

Choosing a Memphis Foreclosure Attorney

Choosing a Memphis Foreclosure Attorney

Our attorneys have stopped hundreds of foreclosures in Memphis, and we’d love to help you as well.

For 30 years, we’ve represented the people of Memphis who need to stop foreclosure. As a result, we’ve built up countless great reviews and referrals. We have a 5-star rating on Avvo, an A+ from the Better Business Bureau, and multiple awards for client satisfaction.

But most importantly, we’ve helped so many people stay in their school districts and neighborhoods, keep their communities active, and rebuild their lives without debt.

If you’re facing foreclosure, don’t wait until it’s too late to get help. We offer a free consultation to answer your questions and help you figure out your options.

Call us today at 901-327-2100 or contact us online to get started, no strings attached.

Case Inquiry Contact Form

Common Myths About Foreclosure

Foreclosure is such a scary thing that a lot of people have created myths around it to help them make sense of it. As a Memphis bankruptcy lawyer who helps people stop foreclosure every single day, I hear these misconceptions a lot.

Here are some common myths about foreclosures, along with the facts.

The foreclosure process begins after one missed mortgage payment.

Although you ideally don’t want to miss any mortgage payments, you won’t lose your home for one missed payment. Most of the time, a lender doesn’t start the foreclosure process until you’ve missed three mortgage payments.

Refinancing will prevent foreclosure.

Unfortunately, this isn’t usually true. If your home is in foreclosure, you can’t count on the bank to offer refinancing at all. In the majority of cases, banks see that as a risky situation and don’t show a lot of generosity. That said, it never hurts to talk with your bank and see what options might be available.

Once the foreclosure process begins, you can’t stop it.

Many homeowners assume that once their bank has decided to foreclose on their home, there is nothing they can do about it. Fortunately, this isn’t the case. You usually still have options up until the auction. The important thing is to move as quickly as possible so you don’t end up in a situation where you actually are too late.

Only financially irresponsible people face foreclosure.

A lot of people want to believe this because they don’t want to admit it could happen to any of us. But something as simple as a job loss for serious medical problem can instantly put a person’s home at risk.

Sadly, there’s still a stigma around people who receive foreclosure notices. However, the majority of people who face foreclosure are hardworking and responsible. They’re just struggling to keep up with their mortgage payments, for all sorts of reasons.

Most all of us have experienced financial troubles at some point in our lives. It’s best to be sensitive and kind to people facing foreclosure and remember how easily most families could end up in their position.

You do not need to hire a lawyer.

If you need to save your home from foreclosure, you definitely want to have an experienced lawyer on your side.

Remember, the banks have their own lawyers. And often the only way out of foreclosure is to file bankruptcy. As a complicated legal process, it’s best to work with a qualified and experienced lawyer who can make sure you don’t make any mistakes.

If you do choose to represent yourself, you run the risk of filing incorrectly and losing your home altogether.

Stop Foreclosure in Memphis | Frequently Asked Questions

Does bankruptcy stop foreclosure?

Yes, filing for Chapter 13 bankruptcy puts an automatic stay on foreclosure proceedings. This legal protection prevents creditors, including mortgage lenders, from pursuing their collection efforts during the bankruptcy process.

What type of bankruptcy is best for stopping foreclosure?

Both Chapter 7 and Chapter 13 bankruptcies are incredibly powerful, but Chapter 13 is usually more effective at stopping foreclosure. Chapter 7 can provide a temporary reprieve, while Chapter 13 allows homeowners to create a repayment plan to catch up on missed mortgage payments over time.

We can help you decide which bankruptcy chapter is right for you. We offer a free consultation to discuss this and any other concerns you might have.

How does the automatic stay work?

The moment you file for bankruptcy, an automatic stay goes into effect. This stops all collection activities, including foreclosure. It provides you with a breather to assess your financial situation and explore options to address your mortgage debt.

With Chapter 13 bankruptcy, you can get back on track through an affordable repayment plan. Chapter 7 might delay foreclosure through the automatic stay; but if you’re unable to catch up on missed payments, the lender may eventually proceed with foreclosure.

Will I lose all my assets if I file for bankruptcy to stop foreclosure?

By definition, Chapter 13 bankruptcy is meant to help you keep your assets when possible. In addition, there are exemptions that allow you to protect certain assets up to a certain value.

Our Memphis bankruptcy attorneys can help you understand how exemptions work and which bankruptcy option is best for your situation. Sometimes it’s not in your best interest to keep your assets to the degree you might think.

Can bankruptcy help if my home is already scheduled for auction?

Filing for bankruptcy, even shortly before a scheduled foreclosure auction, can often provide a last-minute reprieve. The automatic stay will prevent the auction from taking place while the bankruptcy case is active.

However, you definitely don’t want to leave it until the last minute. If you think you’re at risk of foreclosure, you should speak with an attorney as soon as you possibly can.

What are the long-term effects of using bankruptcy to stop foreclosure?

Bankruptcy is a powerful tool that can provide immediate relief from your debts and give you a fresh start. But despite its usefulness, often people worry it will hurt their credit score or make life harder for them in the future.

While bankruptcy does impact your credit score, it also offers an opportunity to rebuild your life better than before. We sometimes have to remind potential clients that their credit is already taking a hit if they’re facing foreclosure in the first place. Why not use this time to get a fresh start and build something stronger than you had before?

To help, we offer a free report called Life After Bankruptcy.

This report answers common questions about your future after a bankruptcy, including how to improve your credit score. We also address getting a new home, whether bankruptcy impacts your employment, and other important questions for having a full and happy life once you’re out of debt.

Why Should I Pick You As My Attorney to Stop Foreclosure?

We are incredibly proud of the work we’ve done at Darrell Castle & Associates to help so many people save their homes. For over 30 years, we’ve helped keep communities together. It’s an honor and a privilege.

We pride ourselves in our communication and attention to detail. When you come to see us, you’re going to get our full attention. We never charge extra to answer your call or communicate with you about the status of your case. And as a result, we’re better able to fight for you and get the results you need.

That’s why we received multiple awards for client satisfaction. And that’s why so many people have referred their friends to us over the years: they trust us and know we won’t let them down.

If you’re facing foreclosure, you want to know you’re in good hands. The stakes are simply too high for mistakes. So talk with the attorney so many people in Memphis have turned to in their worst moments, and let us help you get a fresh start.

For a free conversation, contact us online today or give us a call at 901-327-2100.

More Info:

- Stopping a Foreclosure Through Bankruptcy

- Stopping a Repossession Through Bankruptcy

- Bankruptcy Resources and FAQs

Client Review

“Everyone that me and my wife dealt with were so helpful and understanding. So far they have been wonderful , explained everything very well, where even I understood!! Would highly recommend them.”

Richard Trussell