Everything You Need to Know About Student Loan Debt Forgiveness

Everything You Need to Know About Student Loan Debt Forgiveness

If you’ve been struggling with student loans, the new student loan debt forgiveness plan could change everything. But who qualifies, and what can you do if the loans are still too high?

Here’s what you need to know about the new student loan forgiveness plan, from our Memphis debt attorneys.

The Basics

The new student loan forgiveness plan will forgive up to $10,000 in student debt for individuals who make less than $125,000 a year and married couples or heads of households who make less than $250,000 a year.

Under those same income rules, Pell grant recipients will receive up to $20,000 in relief. Pell grants are awarded to low-income students every year, and thus affect the most people who may struggle to make their repayments.

In addition, the plan would cap payments at 5% of a borrower’s discretionary income. Discretionary income is the extra income you have after paying for taxes and basic necessities. The government keeps this on file if you have an income-driven repayment plan.

For people whose income is low enough that they have low monthly payments, interest can build up over time and make the total loan grow bigger. This plan would cover that unpaid interest so the loan size doesn’t balloon.

The plan would forgive remaining balances after 10 years instead of the current 20 years.

Lastly, the pause on all federal student loan payments continues through 2022. Repayments will begin again in January 2023.

How Do I Know If I Qualify?

How Do I Know If I Qualify?

Eligibility is determined by tax year 2020 or 2021 and will use your adjusted gross income. That means the government will take into account all of your tax deductions and adjustments for year 2020 or 2021, like contributions you made to a 401k plan.

If the government already has your income information from an income-driven repayment plan, you should automatically see the debt relief in your account over the next few months.

But if they don’t have your information on file, you’ll have to apply through the Department of Education. Applications will likely open in October, and the Department of Education has a subscription page where you can sign up to be informed when applications open.

If I Receive Debt Relief, Will I Be Taxed for the Difference?

The federal government won’t tax this debt relief, but a few states might.

At the time of this publication, Arkansas and Mississippi seem prepared to tax the debt relief. If taxed, borrowers might owe their state a few hundred dollars by April 15.

As of now, Tennessee does not appear poised to tax student loan forgiveness.

How Will This Affect ___?

Current Students:

If you are currently enrolled in a higher education program with student debt, you may be eligible. Dependent students and students who use FAFSA may apply.

Parents:

Parents who took out Parent PLUS loans or other federal loans on behalf of their children may qualify based on income.

Graduate Debt:

Graduate debt is included in the $10,000 (generally Pell grants only apply to undergraduate degrees). However, graduate debt is currently not eligible for the income cap and other debt relief. As always, borrowers with graduate debt may apply for income-based repayment plans.

Income-Based Plans:

If you’re on an income-driven repayment plan, the amount you owe each month likely won’t change. It’s set by your income. However, the time it will take to pay off likely will change.

FFELP Loans:

These loans were guaranteed by the government but owned by private companies. The program ended in 2010, but the program currently affects 5 million people. As of now, these loans are not included in the plan and still must be repaid at the same amount. However, this might change over the next few months.

Private Loans:

If you took out private loans through a bank, unfortunately the current plan does not include that type of loan. Only federal loans apply.

Pandemic Payments:

If you paid into federal loans during the pandemic, you may be eligible for a refund. You should contact your loan servicer to see if you qualify.

Will This Be Enough?

Will This Be Enough?

For millions of Americans, this loan forgiveness will make a real difference in their monthly budgets. It’s touching to see low-income borrowers suddenly realize their lives have changed. Stories abound online about people instantly having enough to buy food, save for a home, or have children.

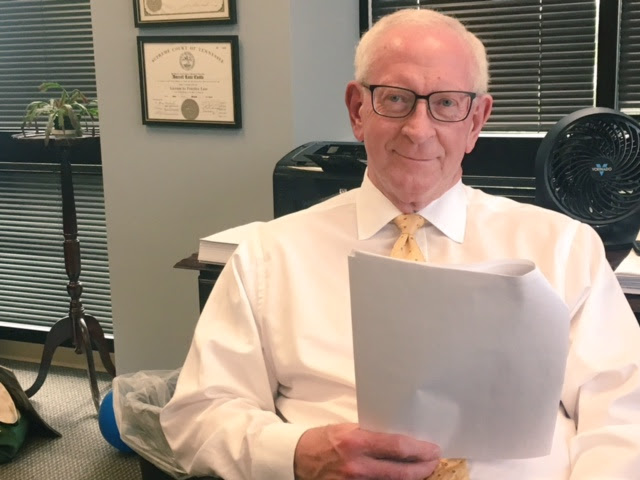

However, a lot of folks either don’t benefit or won’t see a major change. I talk with people all the time overwhelmed by their private loans or unable to pay back massive federal loans. With payments starting up again in January, this number will only grow.

And of course many Americans wonder why one group gets debt relief instead of others. Some people argue that if the government forgives student loans, they should forgive car notes and mortgages.

Can Bankruptcy and/or Debt Relief Help with Student Loans?

I agree this is a very unbalanced system, and the decision is in many ways unfair to a lot of people.

However, there’s a big difference between student loans and your house or car debt: student loans don’t qualify for bankruptcy. They’re one of the only types of debt in America that fall into this category.

Student loans follow you around like an anchor no matter what. If you can’t find a job after college? Doesn’t matter, you still owe them. Family member got sick and you have medical debt keeping you from paying your student loans? They don’t care.

In every other instance, you have a forgiveness option called bankruptcy. In my opinion, it’s outrageous not to offer same option to student loan borrowers. Bankruptcy could have helped millions of people over many decades who simply cannot pay back these massive loans. It likely would have kept education costs in check.

But that’s not the law at the moment. Instead, at our firm we help people manage those payments by dealing with other major debts.

If you’re overwhelmed with debt and don’t know how to make it day-to-day, give us a call and let us help you sort your options. We’re here for you no matter what.

You can reach us at any time by calling 901-327-2100 or filling out the form below.