It’s never too early for a fresh start.

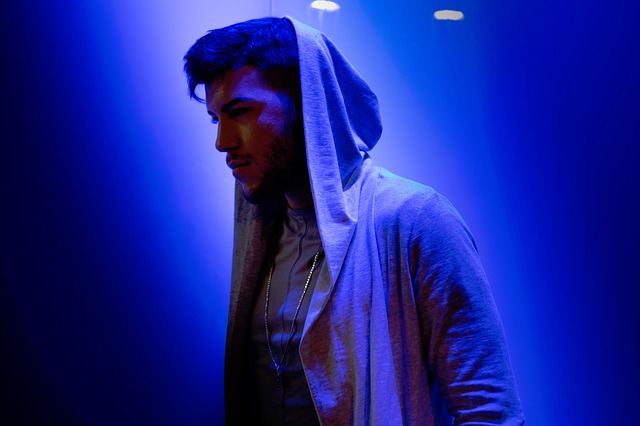

As a Memphis millennial bankruptcy lawyer, I want to tell you that  bankruptcy is for all ages. With skyrocketing education debt, an uncertain job market and a global pandemic, I’m seeing more and more young people turn to bankruptcy.

bankruptcy is for all ages. With skyrocketing education debt, an uncertain job market and a global pandemic, I’m seeing more and more young people turn to bankruptcy.

If done correctly, bankruptcy can set you up for a much better financial future. Imagine having a clean slate without enormous monthly payments hanging over your head. Bankruptcy has the power to give you relief in many ways.

Still, filing is never an easy decision, and it can feel overwhelming. So I’ve put together a guide especially for millennials who are considering filing for bankruptcy.

What if my parents are still involved in my finances?

In most cases, when a young adult files for bankruptcy, it won’t appear on their parents’ credit history or other financial records.

As we all know, early adulthood can be a tough age, and parents are often still involved in finances. Yet, while admitting financial trouble  might make you feel ashamed at first, it’s a good idea to tell your parents about bankruptcy before you start the process. If they are still involved in your finances in some way, it’s important to explain which bankruptcy you have chosen and how it will affect them — if at all.

might make you feel ashamed at first, it’s a good idea to tell your parents about bankruptcy before you start the process. If they are still involved in your finances in some way, it’s important to explain which bankruptcy you have chosen and how it will affect them — if at all.

Debt is often a self-perpetuating cycle, and rarely gets better with time. With bankruptcy, you are taking responsibility for your life and giving your family the best future possible.

Bankruptcy is confidential.

No one is going to call your employer and tell them about your bankruptcy. Apart from creditors and government agencies who may receive formal notification, this is a confidential process.

Bankruptcy is also much more common than many people realize.  Some studies say that at least 1 in 10 Americans has experienced bankruptcy at some point in their lives. If anything, you should expect compassion and sympathy rather than judgment and humiliation. After all, bankruptcy is a way for you to take control of your debt and build your credit up, and that’s a courageous act.

Some studies say that at least 1 in 10 Americans has experienced bankruptcy at some point in their lives. If anything, you should expect compassion and sympathy rather than judgment and humiliation. After all, bankruptcy is a way for you to take control of your debt and build your credit up, and that’s a courageous act.

Will bankruptcy cover my student loans?

Student loan debt can’t be completely wiped away through a bankruptcy. However, the clearing of all other dischargeable debt makes paying student loan debt easier to manage.

In my thirty years as a bankruptcy lawyer, I’ve seen it many times: making your other debts easier to manage allows you to get up to date, and even ahead, on student loan payments. Just imagine how much easier life would be if you didn’t have a credit card payment each month.

Bankruptcy allows you to rebuild your finances.

Unlike older Americans filing, life after bankruptcy looks very different for young people. A bankruptcy will not be on your record forever, and  you’ll have a whole life ahead of you to enjoy your freedom from debt.

you’ll have a whole life ahead of you to enjoy your freedom from debt.

Not only will my team walk you through the entire process of filing, but we can personally help you prepare for life afterwards. We offer a free report on life after bankruptcy to help you get started.

Connect with a Memphis millennial bankruptcy lawyer for FREE.

Call my office at (901) 327-2100 or contact me online for a FREE consultation, no strings attached. We’ll answer all your questions and go over your situation with detail and care.

We’ve helped thousands of young people get out of debt, and we can do the same for you. We’ll use every resource we have to help you get the future you’ve dreamed of.

Don’t wait; a better future is just a phone call away.