Bankruptcy Law Firm Memphis, TN

We Help People Gain a Fresh Start

If you are considering filing for bankruptcy, or would like to explore other options about resolving your debt, please call a leading bankruptcy law firm Memphis, TN residents have been relying on for over a decade. At Darrell Castle & Associates, we provide clients with the right tools they needed to make sound decisions about debt relief and bankruptcy. We’ve built a solid reputation as a bankruptcy law firm in Memphis, TN clients recommend. Let us explain to you what solutions may be available and guide you through each step of the process. Rest assured, as a well respected bankruptcy law firm in Memphis, TN, we can get you through your financial difficulties.

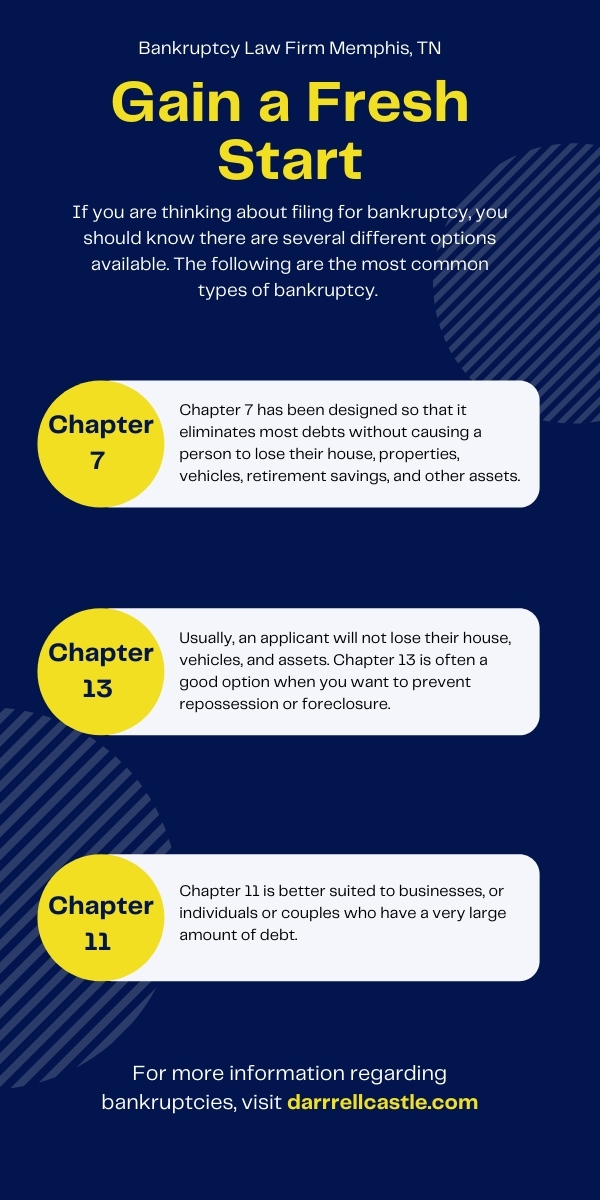

The Most Common Types of Bankruptcy

If you are thinking about filing for bankruptcy, you should know there are several different options available. The following are the most common types of bankruptcy.

Chapter 7 – This is the most common type of bankruptcy, and usually the easiest. Chapter 7 is an available bankruptcy option for individuals, legally married couples, and businesses. Chapter 7 has been designed so that it eliminates most debts without causing a person to lose their house, properties, vehicles, retirement savings, and other assets.

Chapter 13 – Chapter 13 bankruptcy is aimed to reduce most debts through the creation of a consolidated payment plan. Usually, an applicant will not lose their house, vehicles, and assets. Chapter 13 is often a good option when you want to prevent repossession or foreclosure. It is also useful to resolve any legal proceedings that are underway. A person who has filed for Chapter 7 bankruptcy within the last six to eight years can file for Chapter 13.

Chapter 13 bankruptcy is also called a wage earners lantern enables individuals with a regular income to develop a plan to repay all or part of the debt. Under this plan your debtors can propose a repayment plan that makes installments to creditors over 3 to 5 years, and if your monthly income is less than the applicable state mediums and the plan will be years unless the court approves a longer period for cause.

If the debtor’s monthly income is greater than the applicable medium to the plan must be five years, in no case may a plan provide for payments over a period longer than five years, and during this time the law is going to forbid creditors from starting or continuing collection effort.

There are many advantages to chapter 13, it offers you an advantage over liquidation under Chapter 7. It also offers an opportunity to save your homes from foreclosure, by filing under this chapter you can stop foreclosure proceedings and make sure the delinquent mortgage payments over time.

If you file Chapter 13 bankruptcy you still must make mortgage payments that come due during the chapter 13 plan on time, otherwise you’re considered to have delinquent taxes owed on your mortgage again.

- Chapter 13 allows you to reschedule secured debts other than your mortgage for your primary residence and extend them over the life of the chapter 13 plan. This is going to allow for lower payments. Not only this but chapter 13 is a special provision that protects third parties who are liable with the debtor on consumer debts, and it may protect cosigners.

- Chapter 13 acts like a consolidation loan under which the individual makes the plan payments to the Chapter 13 trustee who distributes these payments to the creditors if needed. The debtor never has contact with the creditors while under Chapter 13 protection.

- Chapter 13 eligibility is pretty simple, even if you are self-employed or operating in an unincorporated business you are eligible for chapter 13 relief as long as the individual’s unsecured debts are less than $300,000, and secured debts are less than $1 million. These amounts are adjusted periodically, and a corporation or partnership may not be a chapter 13 debtor.

You may not file under Chapter 13 or any other chapter of bankruptcy if during the preceding 180 days prior a petition was denied or dismissed. This is especially true if you failed to appear before court and the or comply with the orders of court and you were voluntarily dismissed. There are exceptions in an emergency situation where the US trustee, your banker and the administrator will determine if there are insufficient revisions to provide the required counseling, and if a debt management plan is developed during required credit counseling has to be filed with the court.

- Chapter 12 – Chapter 12 bankruptcy is a debt relief option that will eliminate most debts through a consolidated payment plan. It is very similar to Chapter 13, but is geared towards farmers or fishermen.

- Debt Negotiation – For people who do not qualify for bankruptcy, or wish not to proceed with that option, a bankruptcy law firm in Memphis, TN might recommend debt negotiation or debt settlement. This is a process that involves an attempt to settle any debts with creditors by reducing or eliminating them. Businesses, individuals, and married couples can utilize this option.

Bankruptcy can happen to anyone, so make sure you’re protected by contacting a bankruptcy law firm in Memphis, Tennessee. Reaching out to a qualified attorney is a smart way to ensure your bankruptcy goes as smoothly as possible, and you’ll be thankful for the valuable information your lawyer can provide about your next steps on your journey to get out from under serious debt. At Darrell Castle & Associates, we understand that filing for bankruptcy can be a stressful ordeal for anyone, and we’re committed to making sure you know all you can before you commit to your financial restructuring.

Your reasons for declaring bankruptcy may vary. Every case is different, and there are a number of reasons for financial hardship: You could have suffered a serious accident, which led to seriously expensive medical bills; or you could simply be finding it impossible to get out from under your financial obligations. Debt can stack up fast, and it’s easy to get overwhelmed. Filing for bankruptcy provides a way out – but it’s not without downsides. Unfortunately, when it comes to declaring bankruptcy to break free from debt, you’ll be making some sacrifices along the way.

Which Debts Can and Cannot Be Included in a Chapter 7 Bankruptcy?

Not all debt is equal when it comes to filing bankruptcy. You must understand what qualifies for discharge when you want to get rid of your bills, so non-dischargeable balances don’t catch you off guard. Here’s a breakdown of what types of accounts qualify for liquidation.

Dischargeable Debts

Many people accumulate debt over several years. When your income changes or an emergency uses up your savings, getting rid of your debt balances can help free up some money to pay for your living expenses. When reviewing your accounts with a Memphis TN bankruptcy lawyer from Darrell Castle and Associates, PLLC, you’ll be happy to know that most of it may qualify for relief. Some of the most common dischargeable debts are discussed here in detail.

- Credit Card Debt – It doesn’t take long to get in over your head with a credit card. Many accounts have annual fees, monthly minimum payments, late fees and even penalties for not paying the entire balance each month. When your income changes or you reach your credit limit, it can be challenging to make your minimum payment. With maxed-out credit cards, you may soon find that your income goes to making your monthly payments, and there’s nothing left for living expenses. This may even lead to applying for additional credit cards and accumulating more debt. Fortunately, a Memphis TN bankruptcy lawyer can ensure your qualifying credit card bills get included in your bankruptcy.

- Medical Bills – If a medical emergency, surgery or accident has left you with an enormous number of bills, bankruptcy can help eliminate them. This is especially helpful if you haven’t been able to return to work full time and your income is less than it used to be. There is no limit on the amount of your medical bills that the court can discharge, so be sure to review all of your outstanding balances with a Memphis TN bankruptcy lawyer before filing.

- Utilities – Your everyday living expenses include things such as electricity, water and trash services. However, when money is tight, you may find yourself getting behind on these bills as well. All of your past-due utility debts qualify for relief in bankruptcy.

Non-Dischargeable Debts

While the lawyers at Darrell Castle and Associates, PLLC may be able to help discharge the majority of your debt, there are some circumstances where your debts cannot include in bankruptcy. When speaking with a Memphis TN bankruptcy lawyer, be sure to discuss if you have any of the following types of debt.

- Alimony and Child Support are obligations that you cannot include in your bankruptcy. If your payment amount is challenging to keep up with, you need to schedule a hearing with the family courts.

- You must pay past-due taxes, including all penalties and fees. While you can’t get rid of these obligations, you may be able to discuss a payment arrangement with the IRS.

- Student loans are not automatically included in your filing and very rarely qualify for discharge.

- Court-appointed fines due to fraud, reckless acts or embezzlement are not eligible for bankruptcy.

Knowing which debts are allowed in bankruptcy can be confusing. Speak with a Memphis TN bankruptcy lawyer to help answer any of your questions.

What You Own and What You Owe: Your Assets and Bankruptcy

No matter your reason for filing bankruptcy, you’ll need to expect the worst. That means potentially losing many possessions and investments that you’ve built up for yourself. If you file Chapter 7 bankruptcy, you’ll have to liquidate your assets to pay off your creditors. While bankruptcy is a quick way to get a clean slate, in the event of Chapter 7 bankruptcy, you’ll have to sell off much of what you own. The list of assets you may need to sell off is a long one, and includes: second properties, cars over a certain value, collections, heirlooms, and pretty much anything else that’s not a tool for a trade or appliances.

This may seem painful, and it is. After spending years and years of building up your own possessions, it can vanish in an instant due to a stroke of bad luck. Do you really want to lose priceless heirlooms, or that collection you’ve been building since you were young? Chapter 7 bankruptcy gives you a clean slate, but at a steep price. Fortunately, if you reach out to a bankruptcy law firm in Memphis, TN, you can get the legal help you need to protect the assets you own.

Can I Protect My Assets?

It’s possible to minimize your losses in the event of bankruptcy. A qualified bankruptcy attorney can help you develop a plan to protect your assets. There are legal methods to protect what you own, and at Darrell Castle & Associates, we’re committed to ensuring you’re as informed as possible about how you can best protect your assets throughout your bankruptcy.

It can be frustrating to think about losing everything you’ve built up for yourself and your family. We don’t think you should suffer through bankruptcy by yourself. Reach out to Darrell Castle & Associates, and see how a bankruptcy law firm in Memphis, TN can help you develop a solid plan to find your way back to financial stability.

When you call our bankruptcy law firm in Memphis, Tennessee, our knowledgeable lawyers can explain to you the bankruptcy process and answer any questions you might have regarding:

- The benefits of bankruptcy

- Bankruptcy misconceptions

- Eliminating liens

- Stopping foreclosure

- Stopping wage garnishments

- Stopping any legal actions against you

Understanding How Bankruptcy Affects Your Credit Score

As each attorney from our bankruptcy law firm can attest, one of the things that people who file for bankruptcy worry about is how their credit scores will be affected. In many cases, this concern holds them back from moving forward with the process itself. And although it is true that bankruptcy does impact your credit score, late payments and no payments also have a significant impact on your credit rating, as well.

At Darrell Castle & Associates, our experience is that by the time clients finally reach out to find out how filing for bankruptcy can help them, they are usually in a dire financial situation, with multiple late or missed payments. Many of them have already had charge-off accounts and may even be facing foreclosure, vehicle repossession, or liens. All of these things affect your credit score, lowering it, and making it impossible to obtain loans and other lines of credit.

A bankruptcy filing will show up on your credit report for seven to 10 years. A Chapter 13 bankruptcy will stay on your credit report for seven years and a Chapter 7 bankruptcy will stay in your credit report for 10 years. However, that does not mean your bankruptcy filing will have the same impact on your credit score during this time frame. During this time, as long as you pay your bills on time, the impact of the bankruptcy will lessen over time and you could quickly increase your credit score. Starting with a clean financial state will enable you to not only rebuild your credit, but will also enable you to begin saving for your future, like starting a retirement account.

Following the completion of bankruptcy, a credit score will usually drop anywhere from 150 to 250 points, however, many of the clients we help at our bankruptcy law firm find that they can obtain a vehicle loan shortly after filing bankruptcy, keeping in mind that the interest rates will be higher, based on a low credit score. Our clients have also been able to obtain a mortgage through the Federal Housing Administration (FHA). An FHA loan is specifically for borrowers who have moderate or low incomes and are unable to make a large payment on a home. The loans are issued by lenders who are qualified through the government and are insured by the FHA.

Common Bankruptcy Mistakes

Bankruptcy isn’t nearly as taboo as it was many years ago. Many people who are under financial distress are choosing to file for bankruptcy. If you’re in the same boat, it’s a good idea to educate yourself about the process first to avoid making costly mistakes.

As a bankruptcy law firm Memphis, TN provides, our lawyers will share some of the most common bankruptcy mistakes you should avoid making.

Hiding Assets

When you’re filing for bankruptcy, you may be afraid of losing some of your assets and become tempted to hide them. However, neglecting to mention a bank account or transferring funds to a relative isn’t something you want to do. It’s against the law and may result in fines and jail time. If you have done this already, please call a bankruptcy law firm Memphis, TN offers to find out what you should do now.

Purchasing Numerous Items

Some people make the mistake of maxing out their credit cards on frivolous purchases before filing for bankruptcy. They might think it doesn’t matter because they’re going to discharge everything anyway. However, the courts will keep a close eye on your spending habits before you file for bankruptcy. If they find out that you made several large purchases before filing, they likely won’t discharge these items.

Procrastinating

As a well known bankruptcy law firm Memphis, TN respects, our lawyers would like to point out that filing for bankruptcy isn’t a decision you should take lightly. However, you also shouldn’t wait too long to file. The longer you wait to file, the more you will hurt your finances in the long run. If you’re drowning in debt and know that you can’t realistically pay it off, it may be time to file for bankruptcy.

Repaying Family Before Filing

If you borrowed money from family members, it’s understandable that you want to pay them back as soon as possible. However, it isn’t a good idea to pay them back before filing for bankruptcy. The trustee may see the payment as preferential and not allow it. Your family may even be required to pay back the money to the trustee.

Not Calling a Bankruptcy Law Firm in Memphis, TN

When you’re having financial difficulties, you might be tempted to forgo hiring a bankruptcy lawyer in Memphis and handle the matter yourself. After all, it’s just another cost you have to deal with. However, not having a bankruptcy law firm Memphis, TN individuals can rely on by your side could cost you even more in the long run. Bankruptcy law is very complicated and it’s easy for the average person to make mistakes. An experienced bankruptcy lawyer will know the ins and outs of bankruptcy law and will guide you the right way. He or she will protect your legal rights and prevent you from making mistakes that could cost you.

Hiring a Lawyer to Deal With a Debt Collector

Hiring a bankruptcy lawyer in Memphis, TN can help you deal with aggressive debt collectors. You’ve felt the dread when a debt collector calls and is looking for money. You’ve experienced that desperation and could possibly have had to deal with a disrespectful collector. When it seems you don’t know where to turn, you can count on a debt collection attorney. What do they do?

Protect You Against Unlawful Debt Collectors

There are certain things a debt collector can do and there are certain things a debt collector can not do. For example, debt collectors can apply pressure in an effort to get you to pay back a debt, but they cannot threaten you in any way. They can file a lawsuit against you, but they cannot have you arrested. Debt collectors can call you, but unnecessary repeated calls that include profane language and threats are unlawful.

If you feel that the way a debt collector has been acting is unlawful, a bankruptcy lawyer in Memphis, Tennessee can help you fight against those actions. Sometimes when a lawyer gets involved, the debt collection agency ceases to commit the acts right away. Other times, the issue goes to court where your lawyer can represent your case.

Represent You in Negotiating Terms

If a court decides you need to get the debt paid back, your lawyer can help you negotiate with the creditor. In some cases, you could be required to pay the entire debt back, so your lawyer would work on negotiating the terms of repayment. In other cases, your lawyer might be able to get the payback amount lowered so it’s not such a huge burden on you. In either case, having a lawyer do the negotiating is beneficial because he or she probably has experience with similar situations in the past. Darrell Castle and Associates, PLLC have an excellent team of bankruptcy lawyers ready to fight for you.

Help You Fight Against Debt Accusations

There are always those cases in which the debtor paid the debt back already, or paid a portion of it, but the creditor has no record of it or refuses to acknowledge the payment. There are other cases in which the creditor adds non-existent debt to a debtors balance in hopes of getting paid more than he or she is entitled to. All of these situations are dishonest and require the assistance of a lawyer who can fight for your rights against debt accusations.

4 Things to Avoid When Filing for Bankruptcy

It’s easy to rush into things and make careless mistakes when deciding to file for bankruptcy. There are some guidelines involved with the process and then there’s the whole choosing the correct chapter that best suits one’s situation. Once a person has added their assets and their home to the mix, things may get so complicated that getting some professional help from an attorney is a wise idea.

1. Avoiding Filing Income Tax Returns

It should be noted right away that avoiding filing an income tax return is a bad idea. Bankruptcy does not give someone an exemption from filing their taxes for the year, it just makes filing them potentially more difficult. If tax filing for the year is opening up a box of worms, hiring the help of a bankruptcy law firm in Memphis, TN, may prove to be a wise idea in the long run.

2. Avoiding Sloppy or Dishonest Paperwork

Declaring one’s assets and income history is required when filing for bankruptcy. When signing the documents, giving the most honest and accurate information possible is a must. Failure to disclose an asset could result in fines, penalties, or even jail time. An attorney, such as one from Darrell Castle and Associates, PLLC might be able to assist in the document forming process to ensure that all boxes are checked in accordance with state law. Seeking help from a bankruptcy law firm in Memphis, TN, could be the difference in keeping one’s assets that are required to earn a living after the filing.

3. Avoiding New Debt Prior To Filing

In the two to three months leading up to the date which a person intends on filing bankruptcy, unsecured debts that are accrued may not be allowed for discharge. Similar protections are in place for transferring or hiding assets. Speaking with a bankruptcy law firm in Memphis, TN, might help dispel the confusion regarding cash and assets moving hands just prior to filing bankruptcy. It may be best to wait a while longer before filing if a large asset recently switched hands.

4. Avoiding Mistakes on Disclosure Forms

Bankruptcy works quickest when it’s done in a transparent way. An attorney from Darrell Castle and Associates, PLLC might be able to proofread a person’s disclosure statements before filing. A person should have the minimal assets required to work and maintain a living, so the exemptions section needs to be done truthfully so creditors know they can’t sell off everything. They will be granted permission to take and sell anything else that isn’t exempt.

Contact Your Lawyer Today

As you can see, there are several ways it could benefit you to hire a lawyer when you’re faced with a debt collector. With over 30 years of experience in bankruptcy law, Darrell Castle and Associates, PLLC can assist you with debt you can’t pay. As one of the very first bankruptcy firms in Memphis, TN to concentrate in individual consumer bankruptcy, our firm is well-versed in debt collection. Contact a bankruptcy lawyer in Memphis, TN today for more information.

Find Out How Our Memphis, TN Bankruptcy Law Firm Can Help

If you are struggling financially and see no way out, it may be time to sit down with a bankruptcy attorney to find out what legal options you may have. We will evaluate your situation and determine if you qualify for bankruptcy and if so, which type would work the best for your circumstance, Chapter 7 or Chapter 13. Although you may consider filing for bankruptcy on your own, it is critical to know that this process can be complicated and making an error can cause the court to dismiss your filing.

Three Elements of Bankruptcy

You may be weighing your options with how to handle your current debt situation. Your financial situation may have taken a hit due to a variety of circumstances that have left you trying to figure out how to pay your bills. But bankruptcy is no longer a stigma.

Many financial planners might recommend that you file so you can get your money under control now and lay the groundwork for a better future. Before you decide, it may help to explore these three elements of bankruptcy, so you go into the process with a better understanding of what it means and how it works. An experienced bankruptcy law firm Memphis, TN can taylor a plan just for you and your situation. Call Darrell Castle & Associates today.

The Timing of Bankruptcy

You may need intervention with creditors now, but decide to wait a little longer and try to dig out yourself. Once you realize you cannot afford to pay even the rising interest rates and penalty fees, you may choose to go through with it. The timing of bankruptcy may be critical in that you may find yourself embroiled in litigation before too long. Some creditors waste very little time in filing lawsuits against outstanding debtors. Thus, you may want to consider filing sooner rather than later to avoid dealing with the headaches of a collector’s litigation. A bankruptcy law firm in Memphis, TN, like the team at Darrell Castle & Associates, can manage the best timing for your case.

The Type of Bankruptcy

There are two avenues for filing bankruptcy. Chapter 13 bankruptcy establishes regular payments to the court over a three-to-five-year period. These payments are created with the help of a trustee who examines your current financial picture and determines the amount you can afford to pay towards debt. Once payments have been made as mandated by the court, the remaining debt is discharged.

Chapter 7 bankruptcy differs in that the trustee is not looking to negotiate a payment plan, but instead to pay off as much debt as possible with the property and assets you own. This may include things like savings accounts, investments and income property. The trustee sets out to liquidate these items and put it towards the outstanding balances with creditors. Once the court is satisfied that you cannot pay more, the court discharges the rest.

Protections Afforded by Bankruptcy

Filing for bankruptcy, regardless of the chapter, affords you some measure of protection. First, creditors must stop contacting you for payment. Collection companies, primary creditors and the like can no longer send you mail or call you about the debt. These creditors must go through the court and follow the appropriate process. Creditors also cannot file a lawsuit or seize property after you file for bankruptcy.

Understanding bankruptcy and how it helps your financial future may help you decide how to proceed. Contact a bankruptcy law firm Memphis, TN to examine the details of your particular case and devise a strategy to lift you and your family out of debt.

Call Darrell Castle & Associates to Resolve Your Debt

At Darrell Castle & Associates, we focus on bankruptcy law and will be happy to provide with a professional, honest, and knowledgeable assessment. To find out more, call our bankruptcy law firm in Memphis, TN now.

When you need a bankruptcy law firm Memphis, TN trusts, turn to the team at Darrell Castle & Associates.

5 Reasons to Hire Darrell Castle & Associates As Your Bankruptcy Law Firm Memphis, TN

When you are facing bankruptcy it can be a very emotional and hard process for clients. Generally an attorney can really take the burden of the overwhelming process. At Darrell Castle & Associates, our bankruptcy law firm serving Memphis, TN can be at your side from the retainer agreement (contract between the client and the attorney) to the settlement process. Here is 5 reason why you should call Darrell Castle & Associates:

Competent Legal Advice

The attorneys at our Memphis, TN bankruptcy law firm are experienced attorneys with many years of experience. When dealing with finances you want competent legal advice. If bankruptcy is in your best interest we will make that process seem smooth and easy. Our attorney will advice you about:

- What type of bankruptcy you should file

- What you should expect

- What to do to make the process easy

- How you can meet your financial goals

Legal Knowledge

Our bankruptcy law firm in Memphis, TN has handled many types of bankruptcy cases. Our attorneys have a lot of extensive knowledge regarding the bankruptcy laws, local court laws and procedures. In addition our law firm is very well known among the bankruptcy trustees in the area. Overall, you case will depend on what type of bankruptcy you file and each individual facts of the case. Every case is different which is why you need to partner with a bankruptcy law like Darrell Castle & Associates in Memphis, TN that can handle your case.

Smooth Process

The bankruptcy process is very complicated. You may be asked by a trustee to provide additional documents or the creditor may ask specific questions and information. The process can be overwhelming and it requires daily attention that you may not be able devote. Our attorneys at our bankruptcy law firm for Memphis, TN assume the responsibility and make sure we keep you informed in new developments of your case. We will make this seem like an easy process.

Preparing and Submitting Your paper Work

Perhaps one of the most tedious and lengthy processes is filling out and getting paperwork ready. We have specialized software that prepares your files promptly and accurately.

The attorneys from our bankruptcy law firm in Memphis, TN, then file the paperwork with the court. Of course, every process requires the collaboration of our clients. We work with our clients to obtain the right information such as your income, your expenses, your debt etc. Based on that information we submit the appropriate paperwork.

Your Memphis, Tennessee case in a Timely Manner

When dealing with a court case or a bankruptcy filing, time is of the essence. We want to provide you peace of mind during this overwhelming process. After we file bankruptcy, a series of documents and forms will need to be provided to the court. Missing any deadlines could delay the process and or get the case dismissed. You can count on us to be accountable for our work.

Darrell Castle & Associates is looking forward to hearing your case. Do not hesitate to get a free consultation by calling our trusted bankruptcy law firm serving Memphis, TN today!

Bankruptcy Indicators

In most cases, a person may not realize that they have put themselves into deep financial trouble immediately. At times, a person can incur debt over a long period of time. For some, it can be shocking to find that they suddenly are unable to make even their monthly minimum payments or lack the liquidity to pay their mortgage on a monthly basis.

Bankruptcy can be scary, especially when it is looming overhead. You may not be sure of what the outcome may be. Thankfully, the Memphis, TN bankruptcy law firm of Darrell Castle & Associates, PLLC have experience with managing bankruptcy cases. We can go over your particular situation and develop a plan of action. With our assistance, you can have a clearer idea of the road ahead, putting your mind at ease.

Signs You Have Too Much Debt

Some people may not even realize the extent of their debt until they begin to look at it all together. Sometimes, this doesn’t even happen until they begin to realize that the majority of their finances go towards paying for their expenses, with little left over at the end of every month. Here are some common signs that you may have too much debt on your hands:

- You are only able to pay the minimum on your balances. In some situations, you may not even be able to meet this requirement.

- Debt collectors are calling you incessantly.

- You are experiencing a substantial amount of stress or physical side effects as a result of the financial burden you are carrying. Other symptoms could include lack of sleep, headaches, anxiety, and depression.

- You are avoiding going over your debt and coming up with a plan because you fear that you will be unable to manage it.

- Your bills are not paid on time because you do not have enough to pay them. This can result in late fees and a significant impact on your credit score.

- You are regularly using a credit card to cover your daily expenses such as groceries, gas, and other incidentals. By doing this, you are digging yourself into a deeper hole.

- If you are unable to save because your expenses are too high, it may be time to speak with a member of a bankruptcy law firm in Memphis, TN who can help you figure out how to have better financial health.

- You are not able to get credit approval because your debt to income ratio is too high.

Knowing the signs that you are carrying a heavy debt load may be helpful when recognizing whether or not you should speak with a debt counselor. This will be important prior to considering bankruptcy. It may be possible for you to avoid bankruptcy with a solid financial plan. This is far more attractive than filing for bankruptcy, which will carry a mark on your credit for a number of years.

Call us today to set up a free consultation at our bankruptcy law firm Memphis, TN clients recommend. A member of our legal team is standing by and ready to assist you. Don’t keep stressing over whether bankruptcy is the right decision for you. It’s time to take action so that you can take back control of your financial health.

About Bankruptcy and Debt Discharge

We live in a fast-paced and costly world. At times, we may feel as though we cannot keep up with the unpaid bills that keep piling high in our mailbox. We may also feel overwhelmed trying to figure out how we are supposed to pay these debts back when expenses outweigh our income.

For some, the option of filing for bankruptcy may eventually seem like the only reliable option left. It is a good idea to do plenty of research before making this big life decision. Yes, your debt can be eliminated after filing for bankruptcy. However, there are exclusions to this rule and there are payments you may still have to make. Many people choose to consult with a Memphis, TN bankruptcy law firm during the bankruptcy process.

When trying to evaluate your current financial status, you can rely on the advice of a bankruptcy attorney at Darrell Castle & Associates, PLLC. We understand this is likely a very trying and emotional time for you. It can be agonizing to realize that you need help. We are a bankruptcy law firm of compassionate and strategic attorneys in Memphis, TN that will do what we can to get you through this period of hardship.

Bankruptcy In the Short-Term

After filing for bankruptcy, you are from then on protected from creditors. Collection efforts held against you are immediately stopped. This means your creditors must halt from contacting you through any means, including phone calls, emails or letters. Creditors can also be prevented from attempting to repossess property and/or foreclosing your home.

Different Types of Bankruptcy

When filing for bankruptcy, there are three main types that are available. The differences between each type are listed as follows:

- Chapter 7 Bankruptcy: This process usually takes around two to three months, in which your property is sold in order to pay your debts.

- Chapter 13 Bankruptcy: This is a three to five year process where you have to pay towards a portion of your owed debts, with a court supervised payment plan.

Debts That May Not Be Discharged

Contrary to what many people believe about bankruptcy, all of your debts may not be eliminated. Debts that may be exempt from discharge can include:

- Student loans

- Enforced restitution due to a criminal sentence

- Child support and/or alimony payments

- Debts for income and property taxes

- Debts that were not listed in the bankruptcy application

- Fines owed to a government organization

Tips for Better Financial Management after Bankruptcy

Are you drowning in debt and unable to pay your bills each month? Perhaps you are unsure of how you will ever dig yourself out. Outstanding debts can create stress and anxiety. It can impact people’s personal and professional lives. Are you unsure of where to turn? Memphis, Tennessee bankruptcy law firm Darrell Castle & Associates may be able to provide you with the legal experience and support you require when facing possible bankruptcy. Although having to file for bankruptcy can put a substantial mark on your financial record, with diligence, it is possible to better manage your finances after bankruptcy.

Tip #1 Keep Track of Your Spending

As a Memphis, TN lawyer from a bankruptcy law firm can attest, many people don’t realize the extent to which they are spending frivolously. By keeping track of what is going out each month, you can have a better handle on where your money is going and areas where you are able to cut back.

Tip #2 Create a Budget, and Stick to It

Keeping your expenses in your head can be nearly impossible to keep track of. Take the time to sit down and put together a budget using a spreadsheet. Here, you will be able to track your incoming finances with your outgoing expenses. You can then determine how much money is allotted for extra expenses. A budget can provide you with a clear plan of how much you are able to spend in different areas each month. Although it may be difficult, follow the budget you have created to ensure that you are able to stay on track.

Tip #3 Build a Savings Account

The unexpected does occur, and when it does, you should be prepared. When people face things like accidents, tragedy, injury or illness, the financial hit they stand to take can be significant. The attorneys at our Memphis, TN bankruptcy law firm knows that this is a primary reason why many find themselves so far behind and unable to keep up with their expenses. Allot money each month to go into a savings account, so that you are able to provide yourself with a safety net should an emergency arise.

Tip #4 Look at Where You Can Cut Back

Once you have tracked your spending habits, you will have the ability to review where your money is going. This can give you a better idea of where you can cut back. Are you going out for a coffee every morning? Out to lunch or dinner too frequently? Does your cable bill have every channel imaginable. These are examples of areas in which you may be able to cut back on each month.

Facing a bankruptcy can feel as though there is no hope to getting yourself back on your feet again. However, with the help of a bankruptcy law firm in Memphis, TN and by taking steps towards better managing your finances, eventually, you will be able to put this whole thing behind you.

Our Knowledge/Your Peace of Mind

With Darrell Castle & Associates by your side to manage your bankruptcy case, we can give you the peace of mind you deserve when facing the stressors of Chapter 7 bankruptcy. We are dedicated to helping people like you, who have found themselves in debt and unable to pay. Our bankruptcy law firm can offer you with:

- Guidance when making informed decisions

- Knowledge of bankruptcy laws

- The ability to strategically manage your case and navigate the legal system

- Help in stopping harassing calls from creditors

- Review of all your options to make the best decision

Bankruptcy Law Firm Statistics

According to United States Courts statistics, in 2021 in Tennessee there were 19,636 total bankruptcies. Are you considering whether bankruptcy is the right option for you and your family? The process can be overwhelming to contend with. Our bankruptcy law firm can provide you with confidence when faced with such a weighty decision. Contact Darrell Castle & Associates today for help in determining if filing for Chapter 7 is in your best interest.

Bankruptcy Law Firm FAQs

How Can Bankruptcy Help Me?

If you have a mountain of debt that you can’t seem to pay off, bankruptcy can be very helpful. It can erase all of your unsecured debts and help you get a financial fresh start. Declaring bankruptcy can also stop creditors from contacting you and prevent wage garnishments and liens on your property.

Will Bankruptcy Destroy My Credit?

Some people are reluctant to file for bankruptcy because they’re afraid it will ruin their credit. Although your credit rating will take a hit after you declare bankruptcy, you can improve it over time. For example, if you’re unable to get approved for traditional credit cards, consider applying for a secured credit card. After you make timely payments on a secured credit card, your score may go up.

Can Student Loans Be Discharged in Bankruptcy?

While many people are struggling to pay back their student loans, they’re a secured debt and not dischargeable in bankruptcy.

What Is the Difference Between Chapter 7 and Chapter 13 Bankruptcy?

Chapter 7 bankruptcy completely wipes out unsecured debts while Chapter 13 bankruptcy reorganizes them. You’re not required to pay back creditors in Chapter 7, but you must agree to a repayment plan in Chapter 13 bankruptcy. A lawyer from a bankruptcy law firm in Memphis, TN can help you determine which type of bankruptcy is right for you.

If you, for example, are still employed and want to keep your home, it might make more sense to file Chapter 13 bankruptcy. On the other hand, if you don’t have any assets and have a low income, it may be better to file Chapter 7.

Will My Spouse Have to File Bankruptcy?

If the debt is only under your name, there is no need for your spouse to file bankruptcy. On the other hand, if it is a joint debt, it’s recommended for your spouse to file too.

Can I Discharge Medical Bills in Bankruptcy?

Yes. In fact, medical debt is one of the main reasons why people file for bankruptcy. Once the bankruptcy is completed, you won’t have to worry about these medical bills again.

Call Our Bankruptcy Law Firm Today

At Darrell Castle & Associates, PLLC, we have been committed to helping our clients get through troublesome financial times by offering legal advice and guidance. We can empathize with the stress you may be enduring. We know how important it is to obtain financial stability. Our bankruptcy law firm Memphis, TN clients recommend can help you decide if filing for bankruptcy is the best resource for your short-term and long-term financial future.

Darrell Castle & Associates Memphis Bankruptcy Lawyer

5050 Poplar Ave Suite 1600, Memphis, TN 38157

Client Review

“Connie and Jordan made sure everything went smooth for me. They answered every question I had. Definitely made sure it was easy & painless from start to finish.”

Carlye Campbell

[/vc_column_text][/vc_column][/vc_row]