A bankruptcy lawyer in Memphis, TN from Darrell Castle & Associates, PLLC has handled many cases of bankruptcy, and has seen how this resource can help people. A number of myths and misperceptions surround the concept of bankruptcy as it is generally portrayed in American popular culture. For example, a widespread myth exists that filing for bankruptcy devastates an individual’s credit permanently. In reality, bankruptcy only remains on an individual’s credit report for roughly seven years. In addition, the credit-related challenges associated with bankruptcy lessen over time, even though the bankruptcy itself is visible on the individual’s credit report.

This myth serves as only a single example of how much more complex the realities of bankruptcy are when compared to popular over-generalizations about this legal and financial tool. It is partially because the bankruptcy process is nuanced that it is generally a good idea to speak with an experienced lawyer before dismissing it as a viable option for you and your family. If you are struggling financially, filing for bankruptcy may provide you with a host of valuable benefits that will allow you to have a healthier financial future than you would if you simply continued to grapple with overwhelming debt.

Please consider scheduling a consultation with Darrell Castle & Associates PLLC today. The sooner you act, the more legal and financial options are likely to remain available to you.

Preparing for an Initial Bankruptcy Consultation

When preparing for a consultation with a bankruptcy lawyer, it is important to write down any questions you may have about your financial situation, the bankruptcy process generally and/or the kind of attorney-client relationship you can expect when working with a bankruptcy lawyer. As discussions about filing for bankruptcy can be somewhat stressful, it is important not to rely too heavily on your memory at the moment. Writing questions down in advance will help to ensure that you receive the clarifications and guidance you are seeking in regards to important issues.

When you speak with a Memphis, TN bankruptcy lawyer, we will take time to learn about your family’s unique situation. After we better understand your current circumstances, we will be able to advise you about your legal options. Filing for bankruptcy may or may not be your best option at this time. If bankruptcy may be a healthy choice for you and your family, we will talk to you about the different kinds of bankruptcy available and which may serve as an appropriate option.

What Not To Do

Paying off debts is stressful, and difficult to say the least. If you are dealing with collection agencies and relentless phone calls, declaring bankruptcy may be the right option.. The laws for bankruptcy vary by state, so it’s important to understand how Tennessee laws differ compared to others. Our team is here to answer any questions you have about bankruptcy and the filing process.

While most people will need to hear about what to do when submitting their bankruptcy filing, there are also things you should not do during this time:

- File late or leave out important information

- Using your retirement funds without necessity

- Purchasing goods and services for luxury on cash advances or credit

- Transferring or selling property for more than it’s worth

- Filing before receiving an inheritance or other valuable asset

- Failing to file your tax returns

- Selling or transferring property for less than its value

Don’t drain your retirement

Most retirement funds can be protected in bankruptcy. Thus, one of the more unfortunate financial errors that people make is withdrawing funds from their retirement account to pay off debts that bankruptcy would eliminate. Before paying off bills, consider talking to a lawyer knowledgeable in bankruptcy for advice.

Don’t give dishonest information

You will be required by law and penalty of perjury to provide accurate and complete details about debts, income, assets, expenses, and other financial history. If you do not submit the entirety of your paperwork, the court may dismiss the case or it could cause delay and more fees.

Don’t Accumulate More Debt

If you run up debts during the couple months before filing bankruptcy, unless it was for necessities of living, a creditor may object to the discharge by stating you had taken out the loan without intention of paying it off (which is otherwise referred to as fraud). Generally, if you used a credit card or cash advance to buy an indulgent item, you may be accused of presumptive fraud, causing your bankruptcy filing to be denied.

Do’s and Don’ts of Bankruptcy Proceedings

Do Talk to a Bankruptcy Lawyer Immediately

As soon as you start thinking about bankruptcy, you should interview several bankruptcy lawyers in Memphis TN. Many offer a free, no obligation consultation. Having the conversation will help you decide whether and how to file for bankruptcy.

Do Tell Your Attorney Everything

No matter how embarrassed you might feel, it’s better for your attorney from Darrell Castle and Associates, PLLC to know about every purchase and every debt you have. If your lawyer doesn’t know, she can’t help you protect assets and income.

Do Keep Current Paying for Non-dischargeable Debts

Non-dischargeable debts may include taxes, student loans and child support. Your bankruptcy lawyers in Memphis TN, will be able to advise you on the specifics in your case.

Do Keep Track of Expenses, Deposits and Withdrawals

You need to keep detailed records of every expense, deposit and withdrawal you make, down to the last penny. Bankruptcy will poke into every nook and cranny to make sure you’re being forthright throughout the process.

Do Make Sure to List All Debts

From your $3,000 credit card bill to the $20 you owe your best friend for lunch, bankruptcy lawyers in Memphis TN would advise you to list every debt you currently owe on.

Do List All Assets

In addition to debts, it’s critical to list all your assets. Unless your Darrell Castle and Associates, PLLC attorney knows about each asset, he can’t help you protect it in a bankruptcy.

Don’t Leave Out Income

Make sure you account for every source of income, from your job to your side hustle. If you sold plasma or had a yard sale, that counts as income.

Don’t Change Ownership of Property or Money

You may feel tempted to put property or money in a friend’s or family member’s name. The trustee in your bankruptcy will find out, transfer it back and make it harder for you to protect.

Don’t Pay Off Creditors or Family/Friends

This sounds counterintuitive, but you don’t get to pick and choose which creditors you pay back first. Bankruptcy treats all creditors equally and can undo any payoffs you make.

Don’t Withdraw From Your Retirement Accounts

You might consider withdrawing from your retirement accounts. Don’t — your retirement accounts are safe from bankruptcy. Any funds you pull out are not, and may be subject to taxes and penalties that may be non-dischargeable.

Don’t File Until Your Health Is Stable

If you have medical debt, don’t file for bankruptcy until your health is stabilized. You may have more bills coming that you don’t want incurred after you file for bankruptcy.

Bankruptcy Assistance Is Available

If you are struggling financially and are interested in exploring bankruptcy as an option, please consider scheduling a consultation with our bankruptcy lawyers at your earliest possible convenience. Speaking with an experienced bankruptcy attorney will allow you to clarify your legal options and make informed decisions moving forward. Bankruptcy may not be the ideal option for everyone. However, this process has helped millions of Americans regain their footing in order to better ensure a healthier financial future.

We look forward to speaking with you about the bankruptcy process and about any additional and/or alternative legal and financial resources that may benefit you and your family. Contact Darrell Castle, PLLC today to speak with a bankruptcy lawyer in Memphis, Tennessee.

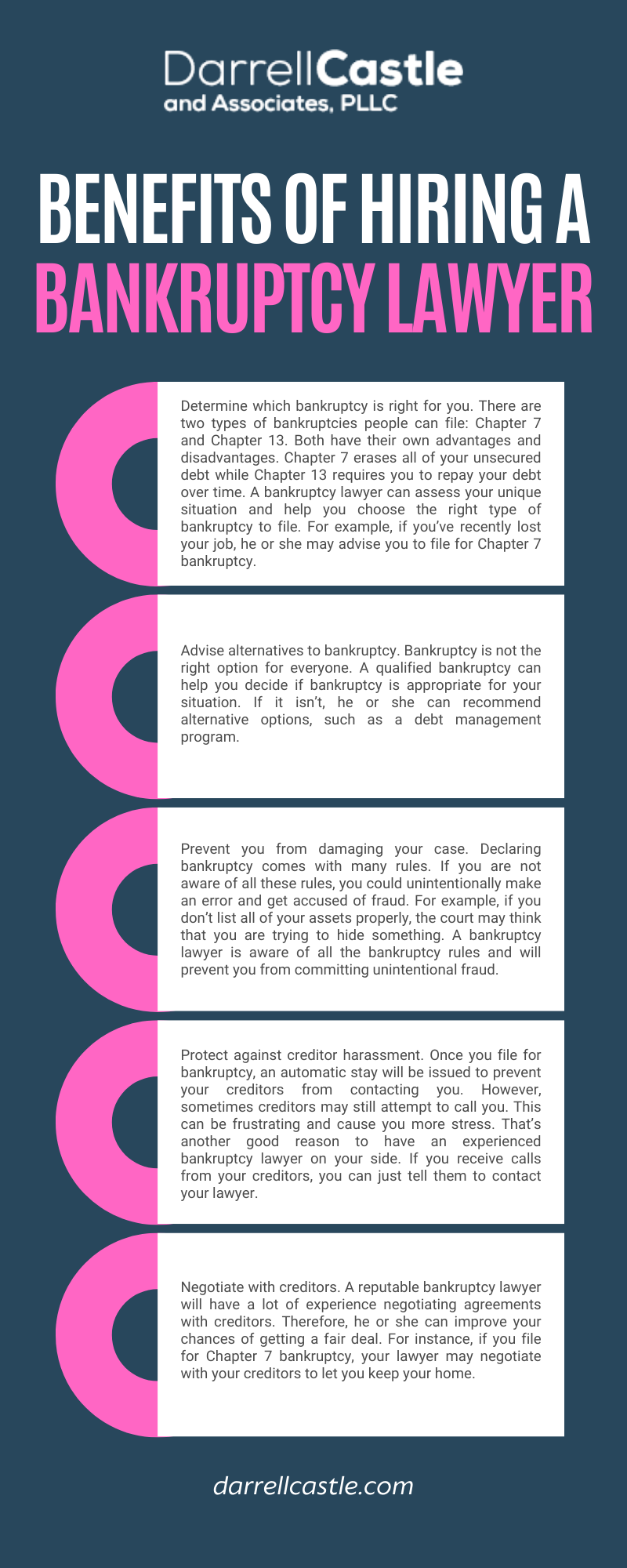

Benefits of Hiring a Bankruptcy Lawyer

If you are thinking about filing for bankruptcy, you might wonder if you should hire a bankruptcy lawyer in Memphis, TN or not. You’re already under so much financial stress and hiring a lawyer will just cost you more money. However, working with a skilled lawyer may pay off in the long run. Here are some benefits of hiring a bankruptcy lawyer.

- Determine which bankruptcy is right for you. There are two types of bankruptcies people can file: Chapter 7 and Chapter 13. Both have their own advantages and disadvantages. Chapter 7 erases all of your unsecured debt while Chapter 13 requires you to repay your debt over time. A bankruptcy lawyer can assess your unique situation and help you choose the right type of bankruptcy to file. For example, if you’ve recently lost your job, he or she may advise you to file for Chapter 7 bankruptcy.

- Advise alternatives to bankruptcy. Bankruptcy is not the right option for everyone. A qualified bankruptcy can help you decide if bankruptcy is appropriate for your situation. If it isn’t, he or she can recommend alternative options, such as a debt management program.

- Prevent you from damaging your case. Declaring bankruptcy comes with many rules. If you are not aware of all these rules, you could unintentionally make an error and get accused of fraud. For example, if you don’t list all of your assets properly, the court may think that you are trying to hide something. A bankruptcy lawyer is aware of all the bankruptcy rules and will prevent you from committing unintentional fraud.

- Protect against creditor harassment. Once you file for bankruptcy, an automatic stay will be issued to prevent your creditors from contacting you. However, sometimes creditors may still attempt to call you. This can be frustrating and cause you more stress. That’s another good reason to have an experienced bankruptcy lawyer on your side. If you receive calls from your creditors, you can just tell them to contact your lawyer.

- Negotiate with creditors. A reputable bankruptcy lawyer will have a lot of experience negotiating agreements with creditors. Therefore, he or she can improve your chances of getting a fair deal. For instance, if you file for Chapter 7 bankruptcy, your lawyer may negotiate with your creditors to let you keep your home.

How to Rebuild Your Credit After Bankruptcy

It is common knowledge that filing for bankruptcy can lower your credit rating. This can make some people reluctant about declaring bankruptcy. However, with a little effort, it is possible to repair your credit over time. Here are some tips for rebuilding your credit score after bankruptcy.

- Apply for a secured credit card. Getting new credit is one of the best ways to start rebuilding your credit score. However, it can be difficult to get approved for traditional credit cards right after declaring bankruptcy. In this case, it may be beneficial to apply for a secured credit card, which requires a cash deposit. If you make timely payments on this credit card every month, you may be able to qualify for traditional credit cards in time.

- Continue to pay non-bankruptcy accounts. Not all debt gets canceled in bankruptcy. If you have secured debts, like student loans or child support, keep up with these payments. If you pay down these balances, it will lower your debt to income ratio and boost your credit rating.

- Make timely payments with new credit cards. Once you are able to get approved for new lines of credit, you will want to make sure that you make all your payments on time. If you have trouble remembering to make your payments every month, consider enrolling in autopay.

- Check your credit report to make sure your bankruptcy is recorded. Credit reports can sometimes contain errors. For example, instead of showing your debt discharged from bankruptcy, it might show the debt as late. That is why your bankruptcy lawyer in Memphis, TN may recommend checking your credit report after bankruptcy to make sure that it was properly recorded.

- Get a cosigner. If you have trouble getting approved for a car loan or other type of loan after bankruptcy, think about asking a close friend or family member to cosign for you. A cosigner is someone who promises to pay back a loan if you don’t. If you make timely payments on a loan cosigned by someone else, it can help your credit score.

- Keep your credit card balances low. Ideally, you will want to keep your credit card utilization at 30 percent or less. This shows creditors that you’re a responsible borrower, which may help increase your credit rating.

Bankruptcy Lawyer in Memphis TN

If you’re thinking about filing for bankruptcy, you may be wondering what the process will look like. You’re probably also wondering what questions you should ask a potential bankruptcy lawyer Memphis TN from Darrell Castle & Associates during your consultation. Here is a list of some important questions that you should ask during your initial consultation appointment:

What Is Bankruptcy?

Answer: Bankruptcy is a legal process designed to help financially distressed individuals and businesses eliminate their debts and obtain a “fresh start.” Depending on the type of bankruptcy filed, some assets may be sold in order to pay off creditors, while other debts may be discharged with no payment required. When you file for bankruptcy, an automatic stay goes into effect and prevents creditors from collecting on debts that may be eligible for discharge or restructuring.

Can I erase my student loans by filing for bankruptcy?

Most people don’t qualify to discharge their student loans through bankruptcy. The law requires you to prove that repaying your loans would impose an undue hardship on you and your dependents. Few people can meet this standard, but if you can, we may be able to help.

What’s the process for filing bankruptcy?

It typically takes about four weeks to complete the filing process, but not all attorneys are able to complete it in less than six weeks. When you come in for your free consultation, we can discuss what to expect in terms of timing. One thing that is important to understand is that you must list all your creditors and debts when you file your petition; missing a creditor can lead to a discharge being denied or revoked. Because we want you to succeed, we take every step possible to make sure this doesn’t happen when we prepare and file your case.

How much does it cost to file for bankruptcy?

The cost of filing for bankruptcy depends on the type of case and its complexity. Contacting an attorney is the best way to determine how much you will need to pay. You should be aware that there are two types of costs associated with bankruptcy: attorneys’ fees and court costs. Attorneys’ fees cover the services provided by your bankruptcy lawyer in Memphis, TN and court costs cover any other fees associated with your case, such as filing fees or credit counseling fees.

Hiring a bankruptcy attorney doesn’t have to be stressful. If you take your time to find the right bankruptcy attorney for you, the whole process can be much less stressful and overwhelming than you anticipate. But there are questions you should ask your lawyer before hiring one, as well as other steps you should take to ensure the best possible outcome in your case. A bankruptcy lawyer is very important in helping you to get out of debt. Thus, when you are planning to get a bankruptcy lawyer in Memphis TN from Darrell Castle & Associates, you must be able to ask the right questions and not just have doubts about the lawyers’ ability.

Bankruptcy Law Firm Memphis TN

When is it most important to seek the most skilled bankruptcy lawyers Memphis TN has to offer? If you’re filing for any type of bankruptcy, it can be beneficial to you to consult with a bankruptcy lawyer to understand the process and protect your rights.

Are you looking for Memphis bankruptcy lawyers who can help you resolve your financial burden? Consider contacting Darrell Castle and Associates, PLLP for assistance and legal guidance. We are here to answer your questions about debt relief and filing for bankruptcy. We are also prepared to guide you through the bankruptcy process.

Deciding Whether or Not You Need an Attorney

It can be challenging to initially determine whether or not you will actually need the help of bankruptcy lawyers Memphis TN locals recommend. While you do not necessarily need to have a lawyer in order to file for bankruptcy, and can fill out the extensive amount of paperwork on your own, it can be invaluable to have a professional help you through every step of the process.

There are a few factors you should consider when considering whether or not to hire an attorney. Ask yourself the following questions:

- Do I actually have the time, patience, and acuity to investigate the bankruptcy filing process, including researching the relevant laws and filling out a substantial amount of paperwork?

- Do I intend to file for Chapter 13 bankruptcy?

- Am I filing for Chapter 7 bankruptcy; if so, is it a simple or a complicated form of bankruptcy?

You may be able to answer ‘yes’ to the first question, in which case, perhaps you are in a position to take on your bankruptcy solo. But most people can avoid a great deal of confusion and pitfalls by working with bankruptcy lawyers Memphis TN residents trust.

How to Find Bankruptcy Lawyers in Memphis TN

In hiring an attorney to guide you through the process of filing for bankruptcy, it is key to find someone who focuses on bankruptcy and debt relief. There are many lawyers out there who try to focus on everything, and in doing so, fail to understand the finer points of helping people escape difficult financial situations. When researching bankruptcy lawyers Memphis TN clients prefer, be sure you make a list of professionals who are well versed in helping clients with Chapter 7 and Chapter 13 bankruptcy, as well as wage garnishment, foreclosures, and repossessions.

- It can also help to look into the following:

- Any bankruptcy attorney referrals you can obtain from family members, friends, or other attorneys who you know.

- Internet directories, especially those that include bankruptcy lawyers.

- County- or state-wide attorney referral websites.

- Your employer-recommended legal plan.

Bankruptcy Attorneys You Can Trust

When you’re ready to work with a bankruptcy attorney who cares about your financial situation, consider contacting Darrell Castle and Associates, PLLP. With over 30 years of experience in representing clients, we are in an excellent position to help you find your way through this difficult chapter in your life. To set up a consultation with one of our bankruptcy lawyers Memphis TN clients trust, call today at 901-327-2100.

Is bankruptcy right for me?

If you think bankruptcy may be a viable option for your unique situation, a bankruptcy lawyer Memphis, TN area residents prefer, from Darrell Castle & Associates is available to provide further advice and direction and discuss what the next steps should be. Those who are new to the idea of bankruptcy will benefit from first becoming familiar with the types of bankruptcy and the fundamental concepts that support the structure of each type.

Types of Bankruptcy

Chapter 7 – Also known as liquidation bankruptcy, Chapter 7 involves a formal exchange of non-exempt assets and properties in exchange for relief from debt. Generally the process the following:

- A formal property and asset evaluation to determine what property and assets qualify.

- In many Chapter 7 scenarios, the debtor’s most valuable assets may remain exempt from liquidation.

- A transfer or sale of qualifying assets to repay creditors.

Chapter 7 is most commonly utilized by individuals who are in need of debt relief.

Chapter 12 – Specifically structured to aid farmers and fishermen that are facing serious debts. The fundamental structure of Chapter 12 involves the following components:

- A formal proposal and execution of a debt repayment plan on behalf of the debtor.

- Repayment over the course of several years.

Chapter 13 – Another form of reorganization that is structured to address the needs of debiting individuals instead of businesses. The fundamental structure of Chapter 13 involves the following components:

- A formal proposal and execution of a debt repayment plan on behalf of the debtor.

- The amount of the payments is determined through consideration of the income level of the debtor.

It should be noted that Chapter 13 and Chapter 7 are the most commonly utilized forms of bankruptcy by individuals who are seeking a path towards resolving outstanding debts.

Advantages of Bankruptcy

In the face of complete financial devastation, bankruptcy acts as a lifeline and is a viable framework for debt relief and resolution. By embarking upon the process of bankruptcy, debtors effectively demonstrate that they are proactively taking steps towards resolving their debts, instead of perpetuating delinquent behaviors. By taking a proactive approach to potentially crippling debts, the rights of the debtor can be protected and complete devastation may be avoided.

Bankruptcy is a useful financial tool for decreasing the overall impact and imminent legal repercussions of not repaying debts but is only a viable option under specific circumstances. An experienced Memphis bankruptcy lawyer from our firm, Darrell Castle & Associates is available to discuss your circumstances. Contact us today to start the conversation. We look forward to hearing from you.

What To Evaluate Before Filing For Bankruptcy

You may want to talk with qualified Memphis, TN bankruptcy lawyers if you have any questions about filing for bankruptcy, bankruptcy is a serious financial decision and you should take your time gathering the information and financial advice that you need before you decide that it is best for your situation. Memphis bankruptcy lawyers like one from Darrell Castle & Associates can do a detailed evaluation of your case and inform you of your options. You may have other debt relief alternatives to bankruptcy such as debt management that you have not previously considered. Here are some things that you can review to see if bankruptcy is the most sensible option for you.

Type of Debt

The type of debt that you have plays a major role in your eligibility for bankruptcy. Most unsecured debt like medical bills, credit card bills, some personal loans, and utility bills can be discharged if you file for some types of bankruptcy, like Chapter 7. If you are a college graduate and have student loans, filing for bankruptcy may be able to discharge your loans but in highly particular cases. You can discuss your financial situation with a bankruptcy lawyer and they can evaluate whether it is possible for you to discharge your debts.

Timeline

The debt relief option that works for you depends on how fast you want to complete the entire process and what you are able to afford. If you want to get rid of your debt faster, you may want to consider filing for Chapter 7 bankruptcy. This type of bankruptcy allows you to complete the entire process in just a few months. There are many people who have their debts discharged in about three to four months when they file for Chapter 7 bankruptcy. Those who file for Chapter 13 bankruptcy in contrast, must complete the process over several years because they have to agree to a repayment plan.

Your Assets

A key part of deciding whether bankruptcy is suitable for you is your collection of assets. If you have multiple, high-value assets and you have a specific plan for keeping them or passing them down, bankruptcy may allow you to keep them. If you hope to protect or keep certain types of assets, then filing for bankruptcy could be the best option. Certain types of bankruptcy allow you to keep your assets and not sell them to creditors. A bankruptcy lawyer can give you more information about the different types of bankruptcy, and which ones you are eligible for.

Your Family Needs

Consider the needs of your family before you file for bankruptcy, because it also impacts them in significant ways. For instance, do you need to be able to preserve your home or property? Then filing for Chapter 13 bankruptcy may be right for you because it allows you to temporarily stall the foreclosure process. This can be a critical part of your decision-making because it can affect your family’s stability.

Find out more about bankruptcy information and legal services from trusted Memphis bankruptcy lawyers as soon as you can.

A Memphis, TN bankruptcy lawyer from Darrell Castle & Associates, PLLC is available to speak with those who are facing severe financial hardship. Filing for bankruptcy can be used as a helpful tool when taken seriously and properly prepared for. Here are questions that clients may ask us as we are handling their bankruptcy case:

Should I run a credit report?

Prior to filing for bankruptcy, it’s a good practice to check your full credit report from several bureaus if you can. Many people don’t realize that there are errors on their reports, and now is the time to get those fixed and ensure your creditors are listed accurately. Keep in mind that filing for bankruptcy will impact your credit score and remain on your report for ten years.

Will financial counseling be mandatory?

As part of any bankruptcy process, you will have to complete a credit counseling course from a state-approved agency. You may have a few weeks or months to complete it, but it’s better to not put it off until the very last second. You need this certificate of completion to move forward in your bankruptcy case.

Do I need help from a lawyer?

There are so many lawyers that you’ll find on the internet. Do not fall for gimmicks where a lawyer says they can guarantee a certain outcome. Unfortunately when it comes to law, nothing is for sure. You must hire a lawyer that is experienced in bankruptcy specifically, as they will understand the complex nuances of this area of law. It may not be required that you have legal representation, but it can increase your odds of approval.

What else can help me during this time?

A part of filing for bankruptcy is being honest with ourselves and how we may have contributed to bankruptcy happening. This is in no way to shame the person, as money hardships can happen to anyone. Getting help from an accountant or financial professional can help you be honest about ways you could manage your money better, to prevent bankruptcy from occurring in the future for a second time.

Contact Darrell Castle & Associates, PLLC

It may initially feel embarrassing to admit the ways that you have struggled with money, but rest assured that your legal team are people you can be honest with. Comprise a list of your debts, personal loan, income, monthly expenses, and assets. Please be forthcoming about your financial situation. If you leave out any details it can make it harder for us to accomplish what needs to be done for your behalf. Consider reaching out to a Memphis, Tennessee bankruptcy lawyer from Darrell Castle & Associates, PLLC today for assistance.

Filing for bankruptcy can be incredibly intimidating. If you or someone you care about is struggling, you need to contact a Memphis, Tennessee bankruptcy lawyer from Darrell Castle and Associates, PLLC right away. Your lawyer will be able to give you advice on whether or not filing for bankruptcy is the right option for you and how to begin moving forward. Regardless of what you choose to do, speaking with a lawyer will give you the clarity you need to get your debt under control and your life back on track.

What Type of Bankruptcy Should You File For?

Typically, when an individual is considering filing for bankruptcy, they are looking at either Chapter 7 bankruptcy or Chapter 13 bankruptcy. Chapter 7 bankruptcy is typically chosen if you need to be completely debt free, while Chapter 13 is picked if you want to try to repay your debts with a payment plan. Chapter 13 bankruptcy is the way to go if you want to keep most of your assets and come up with a payment plan that you can realistically afford to pay off. Chapter 7 will free you from much of your debt, but you will also need to liquidate many of your assets and it will take longer to build your credit back after filing for Chapter 7. You should always speak with a Memphis, TN bankruptcy lawyer from Darrell Castle and Associates, PLLC before making any big decisions. We will be able to go into great detail about what each type of filing will look like for you.

Will Filing for Bankruptcy Ruin Your Life?

Absolutely not. Filing for bankruptcy has a lot of stigmas and judgments tied to it, but sometimes it is the best option for someone who has been down on their luck and just wants to get their life back. It is normal to have some concerns about filing, as it should not be a choice made lightly, but filing for bankruptcy can be a new beginning for people.

What Should You Try Before Filing for Bankruptcy?

Some helpful things people can do before choosing to file for bankruptcy is trying to work out a payment plan with creditors and sticking to a strict budget that will allow you to do so. It is very important to see where all of your money is going and try to ensure that your debts are being paid off at a steady rate. The more in tune you are with how much you owe, the better your chances are of getting out of this difficult situation.

Contact a Bankruptcy Lawyer in Tennessee Right Away

Do not hesitate to reach out to a bankruptcy lawyer from Darrell Castle and Associates, PLLC as soon as you think you may need help. It is better to get on top of things quickly, rather than waiting to see if they can be figured out. This will give you more options and power to choose which route is best for you and your family. One of our experienced lawyers will be happy to go over the details of your finances and help you figure out what the best option moving forward is.

Things You Should Do Before Filing for Bankruptcy

If you’re thinking about filing for bankruptcy, you should speak to a Memphis TN bankruptcy lawyer first. Being in debt is stressful and if you don’t know bankruptcy law, it can be intimidating and confusing deciding what to do. Having someone that is knowledgeable and experienced on your side can make all the difference. Call Darrell Castle and Associates, PLLC today to set up a free confidential consultation with our lawyers. We will clarify your legal options and next steps.

Although bankruptcy gives you a financial fresh start, it will negatively affect your credit in the beginning. Here are some important steps to take before you file for bankruptcy.

Collect Your Financial Documents | The first step you need to take is gathering all of your important financial documents. Ideally you will organize them and put them in one place so they are easily accessible. These documents should include applicable bank statements, tax returns, credit card statements, mortgage statements, loan documents, and collection letters.

Speak with a Lawyer | Declaring bankruptcy is just one option if you are in debt. A knowledgeable bankruptcy lawyer can assess your current financial situation and determine if bankruptcy is the best option for you, and if so, what kind of bankruptcy to declare.

Recognize That Bankruptcy is a Process | The pressure of debt is stressful. Collectors may be aggressively calling you frequently and you may be having a hard time paying for basic necessities. While it would be ideal if you could simply file for bankruptcy and be done, it’s unfortunately not the way it works. Chapter 7 bankruptcy typically takes between four and six months to complete as a court identifies what assets to liquidate and what debts will be repaid. And Chapter 13 bankruptcy can take even longer – between three and five years to complete – since you are completing a repayment plan. Patience is a must.

Ensure Cash is Available | When you file for bankruptcy, your bank may freeze the funds in your account and leave you without access to money. Eventually your bank will unfreeze the funds, but it can take time. To ensure that you can continue to purchase necessities such as groceries, gas, and bills, you should take out cash ahead of time. An experienced Memphis TN bankruptcy lawyer from a firm like Darrell Castle and Associates, PLLC can answer questions about the process so you understand how much money you will need in the interim.

Take a Credit Counseling Course | As part of the bankruptcy process you will need to complete a credit counseling course. This typically needs to take place before you file for bankruptcy. These courses are offered online or in person and you can usually finish them fairly quickly. Upon completion, the company you took the course through will send you a certificate that demonstrates you took the course.

Develop a Budget | To avoid finding yourself in financial trouble again in the future, you should look at your current expenses and develop a budget for going forward. Credit counseling courses can help you understand how to develop a budget, but if you need additional assistance, there are non-profit organizations and companies that can assist you.

Myths About Bankruptcy

Myth: Bankruptcy Permanently Kills Your Credit

Fact: While your credit will be impacted in the short term, in the long run, you’ll be able to rebuild it. Bankruptcy stays on your credit report for seven to 10 years, but after that, your credit score can bounce back quickly. For the first few years, you may only be able to get a secured credit card with a low limit, but responsible use of such a card can improve your credit score.

Myth: If You Recklessly Spend Before Bankruptcy You Won’t Have To Pay That Money Back

Fact: If you spend recklessly before you file for bankruptcy, you’re committing fraud. Debt that’s incurred as a result of fraud isn’t dischargeable in a bankruptcy. An attorney from Darrell Castle and Associate, PLLC might tell you to keep your spending the same before you file for bankruptcy.

Myth: Bankruptcy Discharges All Your Debt

Fact: Not all debt is dischargeable in a bankruptcy. Generally speaking, taxes, student loans and child support can’t be discharged. Most unsecured debt, such as medical bills, credit card bills, utilities and back rent can be dissolved, along with some secured debt like your car payment or mortgage. Your Memphis TN bankruptcy lawyer can give you a detailed list of what is and isn’t dischargeable in your case.

Myth: Anyone Who Files for Bankruptcy Is Financially Irresponsible

Fact: Reckless spending isn’t that common of a reason for bankruptcy. The three most common factors are job loss, long illness and divorce.

- With an unemployment rate of 4.2% as of November 2021, more than 6.9 million people are unemployed, says the U.S. Department of Labor.

- Health System Tracker reports that the cost of medical care rose from $2.59 trillion in 2010 to $3.8 trillion in 2019.

- The average cost of a divorce today is around $15,000, according to Bankrate.

Myth: You’re Going To Lose Everything in Bankruptcy

Fact: Most of your assets are safe during a bankruptcy, including your home, your car and your clothes. Other assets just aren’t that valuable to creditors. On the flip side, your Memphis TN bankruptcy lawyer from Darrell Castle and Associates, PLLC may not be able to protect your yacht or private plane.

Myth: You Can Only File a Bankruptcy Once

Fact: Your Memphis TN bankruptcy lawyer can help you file for bankruptcy more than once. With Chapter 7 bankruptcy, you can file once every eight years. With Chapter 13, you can file as soon as two years, after your repayment plan is complete.

Don’t wait. If you want a Memphis, TN bankruptcy lawyer that will represent your best interests, call Darrell Castle and Associates, PLLC now.

How to Improve Your Credit After Bankruptcy

It’s no secret that declaring bankruptcy hurts your credit. You may have more difficulty getting approved for credit cards and loans afterward. However, that doesn’t mean that you can’t rebuild your credit over time. Here are some tips to improve your credit rating after bankruptcy.

- Make payments to your non-bankruptcy accounts. Not all debts can be discharged in bankruptcy, including student loans and tax debts. If you have any secured loans that weren’t erased in bankruptcy, continue to make timely payments on them. Keeping up with these accounts may improve your credit over time.

- Apply for a secured credit card. After you declare bankruptcy, it will be more challenging to get approved for traditional credit cards initially. However, you can always apply for a secured credit card. This type of credit card requires a cash deposit and is easier to get approved for. After you make timely payments on a secured credit card for a while, you may get approved for traditional credit cards.

- Keep your balance low. It’s always wise to keep your credit card balances as low as possible. It shows lenders that you’re a responsible borrower and will be more likely to repay. Try to keep your credit utilization ratio less than 30 percent.

- Monitor your credit score. Once your bankruptcy is complete, your Memphis, TN bankruptcy lawyer may recommend keeping close tabs on your credit score. Make sure that your discharged accounts were accurately reported and that there are no red flags. While it may take a while for your credit score to go up, checking it regularly and seeing small increases can keep you motivated.

- Use a Co-signer. If you find it difficult to get approved for a loan after bankruptcy, you may consider getting a co-signer. This person agrees to pay back the loan if you don’t. Ask a trusted family member or friend in good financial standing to be a co-signer.

- Create a budget. If your goal is to rebuild your credit and avoid getting into the same situation in the future, it may be time to reassess your budget. Make a list of your expenses and think about what you can realistically cut out. While it may be difficult at first, sticking to a stricter budget can help you get your finances back on track.

How to Discuss Bankruptcy with Your Family

If you are considering filing for bankruptcy, you may wonder how to tell your family members about it. Although you don’t have to discuss your bankruptcy with your family member, you might feel like it’s the right thing to do. If this is the case, consider the following tips.

- Explain that there is nothing immoral about bankruptcy. A common misconception people have about bankruptcy is that it is immoral. They think that only financially irresponsible people declare bankruptcy. They may assume that if you were only more careful with your spending, you would not be in this situation. If you think that your family members may feel that way, calmly explain that bankruptcy is an entirely legal process and it does not make someone a bad person. Let your family members know that many people file for bankruptcy because of job losses and unexpected medical bills, not because they went on shopping sprees and were irresponsible with their money.

- Discuss the benefits of bankruptcy. Many people focus on the negatives of declaring for bankruptcy, such as ruining your credit. That is why it is important to talk about the benefits of bankruptcy with your family members from the get-go. For instance, you may want to mention that bankruptcy will give you a financial fresh start and allow you to build up a larger savings account. Also, tell your family members that you can improve your credit rating over time after bankruptcy and be eligible for loans in the future.

- Talk about the lessons you have learned. A Memphis, TN bankruptcy lawyer may suggest telling your family members about the financial lessons you have learned from filing for bankruptcy. For example, you may have established a stricter monthly budget that will make it easier for you to pay your bills on time. If your family sees that you learned something valuable after declaring bankruptcy and intend to focus on your financial future, they may be more understanding.

- Be open to answering questions. Once you have told your family members that you plan on filing for bankruptcy, they will have several questions. Make it clear that you are open to answering any questions they may have about your decision. Provide them with detailed answers so that they understand everything.

Memphis Bankruptcy Law Infographic

Preparing for Bankruptcy

Many Americans each year find themselves in debt they cannot pay off in a realistic time frame. Whatever the reason may be, hundreds of thousands of Americans are choosing to reset their debt and wait out the seven to ten years it takes to clear off their credit reports. Here are some steps to help prepare for what’s to come when filing for bankruptcy.

Prepare for Automatic Stay

One of the main reasons people decide to file for bankruptcy is the automatic injunction, or stay, that turns on as soon as that person files their paperwork. This is a protection for the person in debt that prevents debt collectors from attempting to collect the debt. They will no longer be able to call or send letters regarding the unsecured debts that a particular chapter of bankruptcy is set to discharge. Creditors will no longer be able to file suits or garnish wages either. A Memphis TN bankruptcy lawyer can assist with this part of the process and recommend what best to do before and during the automatic stay.

Prepare for the Right Chapter

If you risk having your home go into foreclosure, or if that is already taking place, chapter 13 is the better path to choose as compared with chapter 7. Those are the two chapters most people use who don’t have businesses and other complicated assets on the chopping block. If there aren’t many assets and a person doesn’t own a home, then chapter 7 may be the best way to go. The automatic stay triggers at the beginning of both chapters, but the downside with chapter 7 is a person could still lose their home even with the automatic stay. For information about the various other chapters in bankruptcy, speaking with an attorney from Darrell Castle and Associates, PLLC might prove to be very helpful. A Memphis TN bankruptcy lawyer who deals with this sort of thing all the time can likely offer valuable information.

Prepare for the Means Test

Each state has different measurements for people who choose to file for bankruptcy. Help from an attorney, such as one from Darrell Castle and Associates, PLLC, can be crucial for getting the process done in compliance with the law. This “means test” checks one’s income against the state’s median income. Also, if a person has filed for bankruptcy in the last eight years they may not be eligible to do it again so soon. A Memphis TN bankruptcy lawyer might be able to assist with calculating the means test as it applies to a person’s particular income and assets and then help make a list of assets that could be considered exempt from liquidation.

Memphis TN Bankruptcy Lawyer

Filing for bankruptcy is a decision that you should not take lightly. You must understand the consequences of filing for bankruptcy and the impact it will have on your life. Consulting with a Memphis TN bankruptcy lawyer can help you to understand more about the process and decide whether or not it is the right choice for you.

What is a bankruptcy lawyer?

A Memphis TN bankruptcy lawyer is a lawyer who specializes in helping clients file for bankruptcy. Bankruptcy is a legal process where members of the public are able to declare that they are insolvent and unable to pay back any debts they owe. By declaring bankruptcy, debtors are able to have their debts forgiven. Darrell Castle & Associates helps their clients file the paperwork and navigate the court system to have their debts forgiven.

What can a bankruptcy lawyer do for me?

A bankruptcy lawyer can help you navigate the difficult process of filing for bankruptcy and avoid mistakes. The bankruptcy process itself can be quite complicated and you’ll need to fill out and file many forms, including ones on which errors could be very costly. A bankruptcy lawyer will also be familiar with any local court processes that might differ from the national guidelines.

What kinds of cases do bankruptcy lawyers handle?

Bankruptcy lawyers generally only handle cases in which an individual or business has declared they are insolvent and unable to pay back any debts they owe. Cases involving child support, alimony, taxes, and other types of debt are all typically not covered by bankruptcy law and a Memphis TN bankruptcy lawyer will be unable to help you with these cases.

How do I find a good bankruptcy lawyer?

Finding a good bankruptcy attorney can be difficult. If you’ve filed for bankruptcy before, you may wish to consult your previous attorney for advice on hiring another one now. Other than this, finding a good attorney depends on how much research you’re willing to do. You’ll want to hire an experienced attorney like Darrell Castle & Associates who has worked as a bankruptcy lawyer for multiple years, if not decades.

Do I Qualify For Bankruptcy?

Most people qualify for Chapter 7 or Chapter 13 relief under the U.S. Bankruptcy Code. There are some income requirements for Chapter 7 bankruptcy, but even if you don’t meet them, you may qualify for Chapter 13 relief instead. The best way to find out whether bankruptcy is right for you is to talk with an experienced Memphis TN bankruptcy lawyer about your specific situation.

Why should I hire a bankruptcy lawyer?

Many people try to file for bankruptcy on their own, especially if they have a simple case. While this may seem like a good idea in principle, it’s important to remember that even an easy case can become complicated very quickly. A single error in your paperwork could cause your entire filing to be rejected, which would mean starting over from scratch and paying additional fees besides. Also, you’ll need to fill out many complex forms correctly the first time — if you make any mistakes, it’s likely that your filing will be rejected, regardless of how minor the mistake is. Hiring Darrell Castle & Associates ensures that your paperwork will be filed correctly from the start.

How Will Bankruptcy Affect My Child Support Debt?

Naturally, when you’re suffering a financial hardship, paying any monthly becomes taxing and nearly impossible. As much as you may love your children, the reality is that paying child support each month doesn’t somehow become easier or possible just because you want it to be. You may be months or even years behind in child support payments so this is one of your biggest debts. If that’s the case, you may hope that child support debt is a debt that you can discharge.

However, you cannot discharge child support debt. This is true even if one or all of your children have now reached the age of the majority if you are still in arrears. Child support is the right of the child, not the parent. Rendering financial aid to your child is a legal obligation, and it’s a duty that filing for bankruptcy won’t wipe out. Also, bear in mind that bankruptcy court and family court are separate divisions.

Fortunately, there is a possibility that you may at least lower the amount that you’re ordered to pay each month. A family court judge may lower what you owe monthly if there’s a substantial change in your income. Proof of financial hardship that requires you to file for bankruptcy is a substantial change. But before you apply for a reduction, call the knowledgeable Memphis TN bankruptcy lawyers of Darrell Castle & Associates. Otherwise, you may misquote or forget to include essential information and risk not getting the results that you desire.

What Are Other Bankruptcy Chapters I Can File For?

This may come as a surprise, but there are other bankruptcy chapters aside from Chapter 7 and Chapter 13 bankruptcy. As you know, Chapter 7 bankruptcy liquidates your assets and sells them off so that the profit from your sales can pay off your creditors. Chapter 13 bankruptcy, on the other hand, reviews your income, consolidates your debt, and puts you on a three-to-five-year payment plan to pay off your creditors. But have you heard of Chapter 12 bankruptcy?

If you’re a farmer or fisher, then you should know about Chapter 12 bankruptcy. Chapter 12 is carved out exclusively for farmers and fishers who come under financial hardship. For a farmer or fisher to qualify for this form of debt relief, you must prove that you have or will have enough income to pay off your creditors in three to five years. Please note that you may file as an individual or spouse, or as a farming or fishing company.

Client Review

“The Castle Firm, and the entire staff are just wonderful. I really needed help, and they took the time to listen to me, and help me with a Chapter 7 Bankruptcy. They are very knowledgeable. Mr. Castle, Ms. Connie, Amanda, and Mr. Prentiss are just wonderful, Service is A1 all the way, and can not be beat. The Castle Law firm make you feel welcome, and comfortable on every visit. I appreciate everything, and thanks to them, I am off to a fresh start, and free of all the stress.”

S Coleman